This document was developed by the Association of Economic Cooperation of the entities of the Russian Federation within the North Caucasian Federal District (hereinafter North Caucasus Association) for the purpose of a comprehensive analysis of investment activity of the regions of the North Caucasian Federal District (NCFD), including the formation of a list of potentially attractive economic activities for the subsequent formation of a pool of possible investment projects in the NCFD, including by organisation of industrial integration between its subjects.

As a result of the regional analysis, the main types of activities and commodity groups potentially interesting for investment attraction in each region of the NCFD were identified.

Roscongress Foundation analysts highlighted the main theses of this research, accompanying each of them with suitable fragments of video broadcasts of panel discussions held as part of business programs of the key events hosted by the Foundation.

An important criterion of the regions investment attractiveness is its ability to increase sales in the domestic and foreign markets.

Based on the results of the analysis of data for 2019, we can conclude that the Stavropol Krai accounted for the bulk of imports to the NCFD regions (64.9%) and the Republic of Ingushetia accounted for the least (0.7%).

In the structure of imports as a whole in the North Caucasian Federal District, the products of such type of activities as «Machinery, equipment and transport vehicles» prevail 40.8%, «Foodstuff and agricultural raw materials» 15.5% and «Metals and their products» 13.3%, «Chemical industry products and rubber» 12.6%.

Chemical production accounts for 46.4% in the structure of exports from the North Caucasian Federal District, and this item accounts for the major share of exports from the Stavropol Krai (53.5%) and the Karachay-Cherkess Republic (32.6%). Agricultural output includes 32.5% of NCFD exports. The share of agricultural products in the structure of exports is leading in all regions except for the Stavropol Krai and the Karachay-Cherkess Republic, while in the Chechen Republic the export ratio for these products was 90.3%.

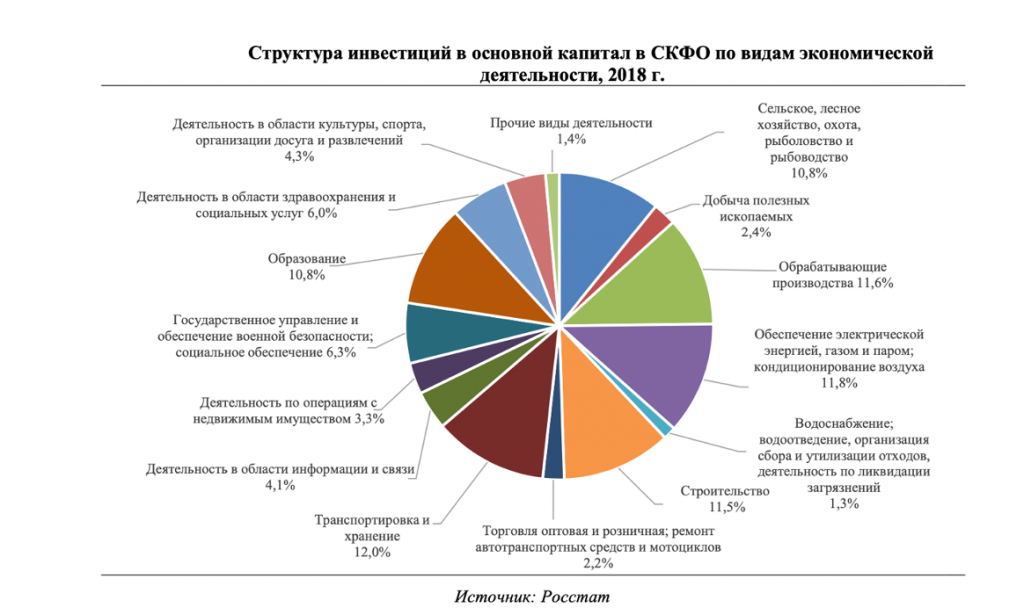

Analysis of the current level of investment in the regions of the NCFD shows that at the end of 2018 the volume of investment was 3% of the total investment in Russia. The main purpose of the investment is transportation and storage, the second place is occupied by investments related to provision of electricity, gas and steam, and the third place is occupied by processing industries.

At the end of 2018, the volume of investments in fixed assets in the NCFD was RUB 550,920.4 million, which is 3% of the total volume in Russia. The Republic of Dagestan accounts for the largest share in the total volume of investments 36.6%, while the republic has been the leader in this indicator for the past few years.

The largest share in the structure of investments in fixed assets is occupied by such activities as transportation and storage (12%), electricity, gas and steam supply (11.8%), processing industries (11.6%), construction (11.5%), agriculture and education (10.8% each).

In the structure of investment financing, the share of federal budget funds exceeds similar values in Russia, while the share of credit funds is insignificant (5.5% in the NCFD against 11.2% on average for Russia). The share of budget financing in the Stavropol Krai is consistently lowest. In the Chechen Republic, there is an annual decrease in this share. Despite the decline in the share of budget funds in financing in 2018 in almost all subjects, the Republic of Dagestan and the Republic of Ingushetia remain high 69% and 66% respectively.

The NCFD ranks last among the federal districts in terms of foreign investment attraction, with the regions share in the total volume of Russia in 2018 being 0.1%. In 2011-2018, the Stavropol Krai accounted for the overwhelming share of foreign investments (85.9%).

We suggest you to familiarise with other materials placed in special sections of the Roscongress Information and Analytical System Entrepreneurship and Investment Climate dedicated to the measures to develop entrepreneurship and strengthen the investment attractiveness of the regions, as well as individual sections for each of the regions entering the