Making a direct comparison between the Chinese and the Russian bond markets is a very challenging task. One should understand that bond types, economic environments, and financial systems in the two countries are very dissimilar. The difference in the size of the markets is staggering, both in absolute value and in terms of economic scale. Nevertheless, the two markets share many features such as comparable age, significant government influence, and destabilized risk assessment.

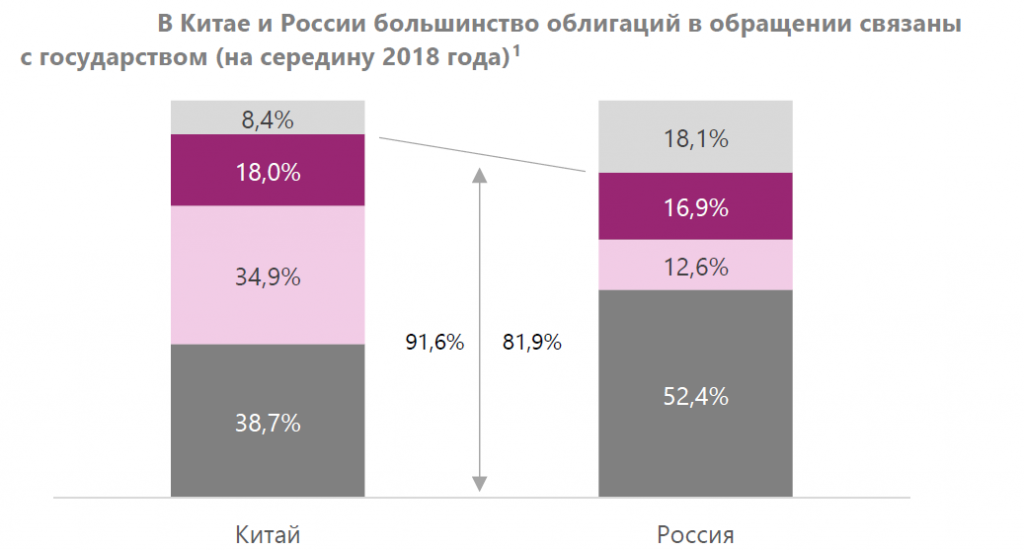

The Chinese and the Russian bond markets are both characterized by a high degree of government influence. Most outstanding bonds are either directly issued by different levels of government or known to have explicit or implicit government guarantees (issued by state-owned or systemically important enterprises). This is true for around 80% of bonds. An important part of the governments influence is the regulation of bond issuance, exchange, and holding.

Both China and Russia have the problem of relative short-termism of bond markets and overall credit. For China, the reason is that with the downward pressure of economic growth, corporates willingness in making long-term investment declines, and the risk appetite of commercial banks goes down. For Russia, the scarcity of long-term papers is possibly caused by less predictable interest rates and exchange rate environment, as well as the overall low trust of households in financial institutions and investments.

There is a persistent difference in market yields to maturity for bonds of different macro-sectors, but this cannot be totally attributed to the risk perception. In addition to credit quality, the factors of bond prices (like taxation, liquidity, and government policies) are at least as influential. In China, differences in taxation generate possibly at least half of the G-spread of high-quality corporate bonds, which is not as important for Russia where the taxation is more unified.