PwCs bi-annual survey of business crime reports that fraud committed by customers tops the list of all crimes experienced. Businesses report that customer fraud and cybercrime are the most disruptive of all the crimes.

With nearly half of the more than 5,000 respondents reporting a fraud in the past 24 months.

Are we assessing threats well enough...or are gaps leaving us dangerously exposed? Are the fraud-fighting technologies weve deployed providing the value we expected? When an incident occurs, are we taking the right action?

These are some of the provocative questions that lie at the heart of the findings in this years Global Economic Crime and Fraud Survey. With fraud a greater and more costly threat than ever, its essential to assess your readiness, deploy effective fraud-fighting measures, and act quickly once its uncovered.

The Roscongress Foundation presents the salient points of the publication accompanied by fragments of broadcasts of relevant panel discussions from the business programme of international events held by the Roscongress Foundation.

With nearly half of the more than 5,000 respondents reporting a fraud in the past 24 months. US$42B losses reported due to fraud in the last 24 months.

Most disruptive fraud events by industry:

· Consumer Markets (Customer Fraud 18%)

· Energy Utilities & Resources (Bribery and Corruption 17%)

· Financial Services (Customer Fraud 27%)

· Government & Public Sector (Cybercrime 17%)

47% told us they had experienced fraud in the past 24 months. This is the second highest reported level of incidents in the past 20 years. On average, companies reportedly experienced 6 incidents in the last 24 months. Top 4 types of fraud:

1. Customer Fraud

2. Cybercrime

3. Asset Misappropriation

4. Bribery and Corruption

Fraud losses are complex. Some costs can be tallied: direct financial loss or costs due to fines, penalties, responses and remediation. But some costs are not easily quantified including brand damage, loss of market position, employee morale, and lost future opportunities.

US$42B losses reported due to fraud in the last 24 months.

Antitrust, insider trading, tax fraud, money laundering, and bribery and corruption are reported as being the top five costliest frauds in terms of direct losses sometimes compounded by the significant cost of remediation.

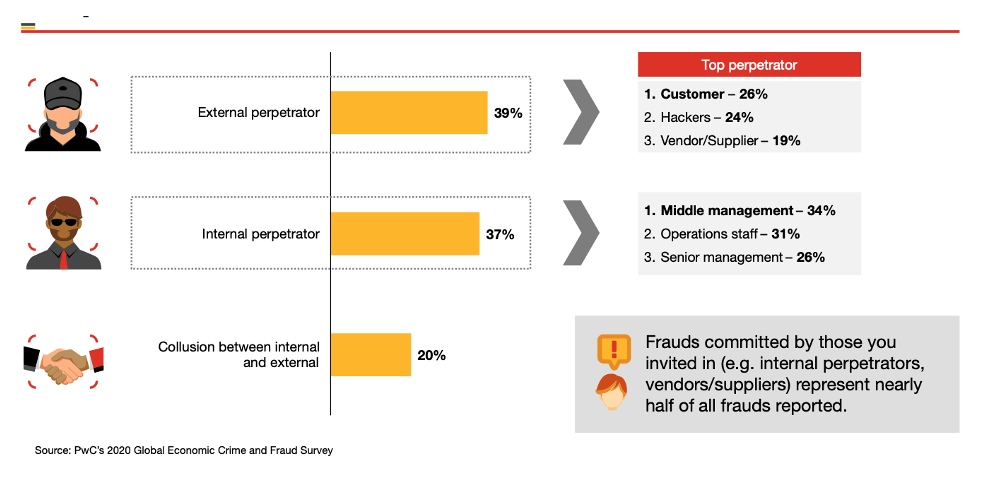

Fraud hits companies from all angles the perpetrator could be internal, external or in many instances there is collusion.

In the last two years, 39% of respondents said external perpetrators were the main source of their economic crime incidents.

Сustomer fraud is especially prominent in the Financial Services and consumer markets sectors. This could be significant, as more industries shift to direct-to-consumer strategies.

Of those who reported experiencing fraud nearly 3 in 10 were also accused of committing a fraud, corruption, or other economic crime:

• In almost equal numbers, competitors, regulators, employees, and customers were most likely to point the finger.

• Enhanced regulatory focus, and in some territories, whistleblower incentives may contribute to this trend.

The benefit in using technology to fight fraud is undeniable but organisations must recognise that using tools or technology alone does not amount to an anti-fraud programme.

Nobody wants to fall victim to (or worse, stand accused of) fraud. But theres another way to look at a major disruptive event: as an inflection point, a possible trigger to organisational transformation. Whether that transformation is negative or positive a full-blown crisis, or an improved market position for example depends on how well the business was prepared and how it was managed.

The data shows that theres a significant upside to taking stock when an incident strikes. Large companies are even more likely (52%) to say they emerged better off citing adoption of new technology and fewer repeat incidents, in addition to a better environment and streamlined operations.

While technology is just part of the answer in fighting fraud, the report finds that more than 60% of organisations are beginning to employ advanced technologies such as artificial intelligence and machine learning to combat fraud, corruption or other economic crime. However, concerns about deploying technology are linked to cost, insufficient expertise and limited resources. 28% say its because they struggle to see its value.

For more information about construction as a sector with a sizeable share in many economies, rising level of digitalization, and shifts in consumer sentiment in real estate, please see the Supervision and controls, Legal regulation, Cybersecurity and Entrepreneurship.