Value-added tax (VAT)

Once the new rules for VAT on e-services took effect in 2019, many foreign companies began facing difficulties with their practical application.

In particular, from 2019 foreign organisations are required to pay VAT independently not only on e-services, but also after registration with the Russian tax authorities on VATable services rendered in a non-electronic form (non-electronic services). That said, special taxation rules established for electronic services do not apply to non-electronic services, which results in differences in the taxation of electronic and non-electronic services rendered by foreign organisations registered with the Russian tax authorities.

Until 1 July 2019, taxpayers were not entitled to deduct the amount of «input» VAT on the sale of work and services if Russia was not recognised as their place of sale. These VAT amounts represented additional costs for service providers. Effective from 1 July 2019, amendments to the RF Tax Code entered force, which stipulate that such amounts of VAT may be deducted.

Until 1 January 2019, services involving the maintenance and repair of goods during their warranty period for no additional fee including the cost of spare parts and components thereto were exempt from VAT. The amendments, which entered into force from 1 January 2019, enable organisations to waive the exemption applicable to the above services based on a written application submitted to a tax authority.

Also, during 2019 a number of amendments affecting the procedure for levying VAT on transactions in the aviation industry were introduced.

Tax Monitoring

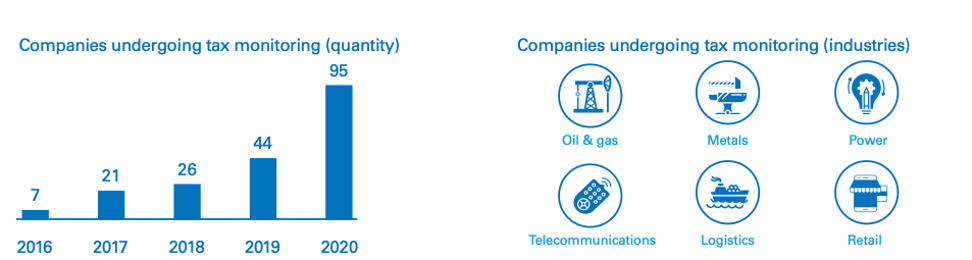

In connection with the need to increase the number of potential tax monitoring participants, it is anticipated that the following criteria for joining this regime will be eased in 2020:

- annual revenue from RUB 2 billion (previously from RUB 3 billion);

- assets from RUB 2 billion (previously from RUB 3 billion);

- taxes paid at least RUB 200 million (previously at least RUB 300 million).

The number of potential participants is expected to double thanks to such measures. It should be noted that if a company meets these criteria when joining the tax monitoring regime, it is highly likely that subsequent checks for compliance with these criteria to prolong participation in the regime will be abolished from 2020.

Corporate profits tax

The following clarifications regarding depreciable property were introduced:

-

the criterion of the «write-off of the value through depreciation» has been excluded from the definition of depreciable property, in other words, property owned by the taxpayer and used by the latter to derive income for more than 12 months and worth more than RUB 100,000 is deemed depreciable (paragraph 1, clause 1 of article 256 of the RF Tax Code);

-

in addition, it is implied that depreciation may be charged on fixed assets transferred for gratuitous use, furthermore, corresponding expenses will not be recognised in tax accounting (clause 16.1 of article 270 of the RF Tax Code).

The explanatory note on the draft law indicated that the purpose of these amendments was to provide an opportunity to form the «tax» residual value of assets not used in income-generating activities, adjusted for depreciation, which is not included in tax expenses.

Specifically, the limitation on the amount of losses carried forward (not more than 50% of the tax base of the current period) has been extended for one more year until 31 December 2021 (clause 2.1 of article 283 of the RF Tax Code), and an additional test on the business purpose in the event of the acquisition of loss-making companies has been introduced directly into article 283 of the RF Tax Code.

Tax authorities continue analyzing critically and reinterpreting the tax accounting treatment of intra-group payments made by Russian subsidiaries to foreign recipients.

Corporate property tax

Since 2019 movable property has been excluded from the list of taxable assets. At the same time, taxpayers will be required to determine and allocate independently assets as movable/immovable property categories and duly discharge their obligations regarding the calculation and payment of corporate property tax.

Effective 2020, the list of immovable property taxed at cadastral value has been expanded. The initial amendments stipulated an expanded list of real estate properties taxed at their cadastral value. The version of sub-clause 4, clause 1 of article 378.2 of the RF Tax Code included all types of property subject to personal property tax in the list of assets in respect of which organisations have to pay tax at their cadastral value.

Effective 2020, organisations are no longer required to submit advance corporate property tax calculations. At the same time, a new corporate property tax return form has been approved.

Other notable amendments and clarifications

Other notable amendments and clarifications to the Tax Code affect capital amnesty; personal income tax; insurance contributions; transfer pricing and the mutual agreement procedure; international taxation; tax administration and tax control; regulation of regional investment projects (RIPs); reform of the special investment contract mechanism (SPIC 2.0).

The year 2019 has introduced many amendments in the Russian tax system. In this year, VAT increased to 20%, movable property has been removed from taxable items, laws on special investment contracts have been updated, and the third stage of Russias capital amnesty started. Currency legislation has undergone large-scale amendments. Russia has continued to integrate international regulations and standards to combat tax evasion and the shifting of profits. The Russian Supreme Court has summarised practice on how to apply liability law for tax crimes.

The KPMG experts believe that the year 2020 will clearly be no less intense in terms of the configuration of the tax system.