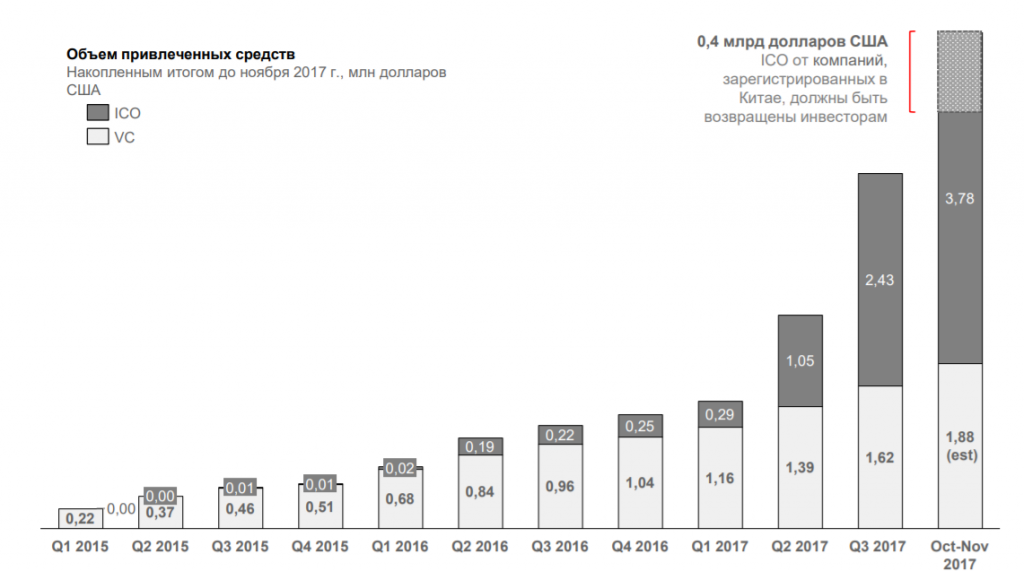

The volume of funds raised through the ICO is reaching $4 billion and exceeds approximately twice the amount of venture investments in block chain projects. In autumn of 2017, the volume of investments started to slow down, fewer and fewer projects have reached the goal of raising funds. This is due to some difficulties in the ICO. Thus, most ICOs use the Ethereum platform.

Because of its popularity Ethereum is overloaded, the rise in the cost of Ether leads to an increase in the cost of the ICO. Terms and functionality of the token are formulated in a smart contract source code that may contain errors or deliberate «tabs». In addition, ICO is of interest to hackers due to its volumes, more than 10% of ICO funds are lost as a result of attacks. Apart from losing funds, the project reputation can be exposed to risks, like investors personal data. This factor also has a negative impact on the popularity of ICO.

Now ICO is a synonym of rush and very high risk. However, this form of crowdfunding offers unique opportunities: for solving any existing problem with the help of the blockchain functional, own token is really needed, and additional financing and active participation of investors improves the project.

From the point of view of protecting the interests of all the participants of the ICO, the transparency of open blockchains is not yet sufficiently used, and there are opportunities for regulators, projects as such and investors. The total amount of funds raised under ICO exceeded $3.7 billion and even outstripped the amount of venture investments.