Energy transition is a radical shift in the global energy system

There is almost a consensus among forecasts provided by various organizations that the share of renewables in the energy mix will rise.

Five years ago, US wind costs were $ 11 c / kWh (US cents per kilowatt hour) and solar costs were $ 17 c / kWh, on a fully loaded basis, including the capital costs of construction. The International Renewable Energy Agency (IRENA) estimates (2018) that global average cost for onshore wind and solar has declined to $ 5 c / kWh and $ 6 c / kWh respectively.

A new record was set in 2016, with a $ 2.4 c / kWh bid in the UAE. It was broken in October 2017 with a $ 1.8 c / kWh bid by Masdar and EDF for Saudi Arabias 300 MW Sakaka plant. Wind power costs have also declined, and as a result, wind and solar have emerged as very competitive sources of energy globally.

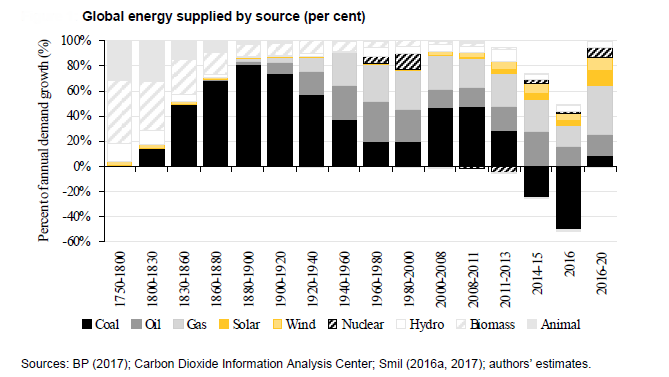

Past energy transitions

According to the authors of this publication, historical evidence indicates that energy transitions follow a certain pattern. At the beginning, the performance of new technologies improves and penetrates the market very slowly but it accelerates at some point thereafter (the inflection point), and finally diminishes when technology becomes mature. Today, many experts believe that wind and solar energy have already reached the inflection point after which the speed of penetration of these technologies will grow at a much faster rate than before.

Adaptation strategy for oil companies

The challenge for oil companies is the disruption of their business models and how to integrate low-carbon assets into their portfolios. The authors of this publication argue that oil companies need to adopt a strategy that is likely to be successful under a wide set of future market conditions.

The authors acknowledge that moving beyond core business is risky for oil companies but assert that a wait-and-watch strategy can be costly. Instead, the authors suggest, oil companies need to gradually extend their business model rather than completely shift from hydrocarbons to renewables. This business model extension implies building an integrated portfolio, including both hydrocarbon and low-carbon technologies assets.

Given that the endgame (in terms of winning technologies) is unclear, oil companies should focus on a combination of competing low-carbon technologies rather than investing in a specific technology.

Adaptation strategy for oil-exporting countries

Oil-exporting countries with proved reserves-to-production ratios of multiple decades face the challenge of monetizing their large reserve base and the risk of losses in export revenues, which could disrupt their socio-economic wellbeing, given the high reliance of their budget on oil revenues. Also, in oil-exporting countries economic growth is tied with energy consumption and thus their domestic energy consumption is expected to rise.

So, for oil-exporting countries, the adaptation strategy is different. There is no conflict between renewable investment and hydrocarbon business in these countries. Their adaptation strategy should be based on their ability to liberate oil and gas for export through investment in alternative technologies.

The authors show that at current oil and gas prices, investment in solar is a viable option in the Middle East oil-exporting countries. The economics of renewables in oil-exporting countries will be susceptible to oil price cycles; nonetheless, when the gains from liberated hydrocarbon are taken into account, this investment rationale is reinforced.

Adaptation strategy for oil companies

The challenge for oil companies is the disruption of their business models and how to integrate low-carbon assets into their portfolios. The authors of this publication argue that oil companies need to adopt a strategy that is likely to be successful under a wide set of future market conditions.

The authors acknowledge that moving beyond core business is risky for oil companies but assert that a wait-and-watch strategy can be costly. Instead, the authors suggest, oil companies need to gradually extend their business model rather than completely shift from hydrocarbons to renewables. This business model extension implies building an integrated portfolio, including both hydrocarbon and low-carbon technologies assets.

Given that the endgame (in terms of winning technologies) is unclear, oil companies should focus on a combination of competing low-carbon technologies rather than investing in a specific technology.

Adaptation strategy for oil-exporting countries

Oil-exporting countries with proved reserves-to-production ratios of multiple decades face the challenge of monetizing their large reserve base and the risk of losses in export revenues, which could disrupt their socio-economic wellbeing, given the high reliance of their budget on oil revenues. Also, in oil-exporting countries economic growth is tied with energy consumption and thus their domestic energy consumption is expected to rise.

So, for oil-exporting countries, the adaptation strategy is different. There is no conflict between renewable investment and hydrocarbon business in these countries. Their adaptation strategy should be based on their ability to liberate oil and gas for export through investment in alternative technologies.

The authors show that at current oil and gas prices, investment in solar is a viable option in the Middle East oil-exporting countries. The economics of renewables in oil-exporting countries will be susceptible to oil price cycles; nonetheless, when the gains from liberated hydrocarbon are taken into account, this investment rationale is reinforced.

In the long run, diversification of their economies is the main strategy that can shield these countries from the effects of energy transition.

During the transition, the oil sector will play a dominant role in the economy of these countries but is expected to start declining if the objective of diversification is achieved. Furthermore, the success or failure of oil-exporting countries in their goal of achieving a diversified economy will also influence the speed of global energy transition (through its impact on oil prices), adding more layers of complexity and uncertainty.During the transition, the oil sector will play a dominant role in the economy of these countries but is expected to start declining if the objective of diversification is achieved. Furthermore, the success or failure of oil-exporting countries in their goal of achieving a diversified economy will also influence the speed of global energy transition (through its impact on oil prices), adding more layers of complexity and uncertainty.