The Analytical Credit Rating Agency (ACRA) has published a study of the outcomes of sub-federal and municipal bond placement in Russia in 2019. The study is the product of expert and analytical cooperation between ACRA and the Roscongress Foundation.

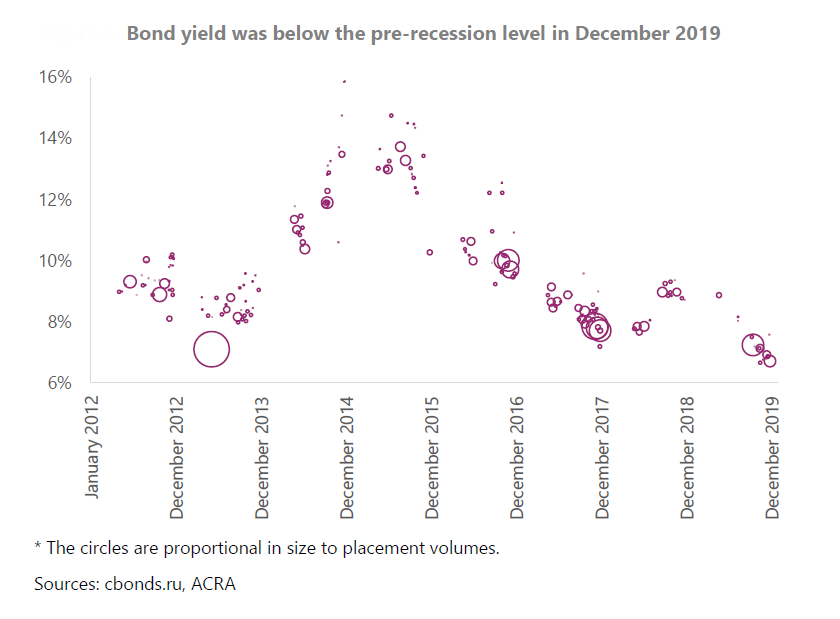

As the Bank of Russia cut its key rate from 7.75% to 6.25% per annum in 2019, the annual weighted average yield on initial bond placements declined to the minimum level for the analyzed period (since 2013) and amounted to 7.2%. Prior to the recession, in 2013, the annual weighted average yield was 8.1%. It was 8.2% in 2017, the peak year for sub-federal placements in the analyzed period.

In 2019, the weighted average yield for initial placements decreased on average by 1 pp compared to 2018. The annual yield on bonds placed in late 2019 was lower than 7%, while annual coupon rates reached 6.5%.

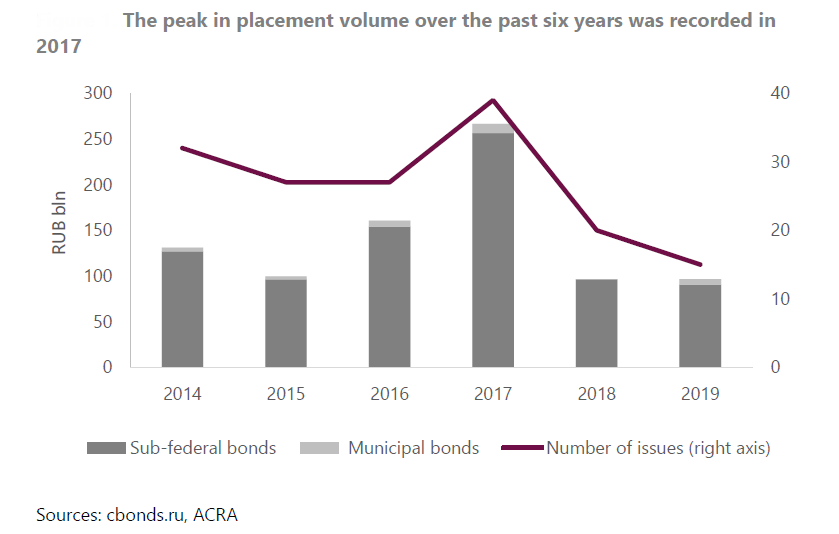

Nevertheless, Russian regions were unable to take advantage of these favorable market conditions to increase the duration of their debt portfolios. In 2019, the total volume of bonds placed by regions and municipalities was equal to that of 2018. Yet at the same time, both the number of placements and issuers decreased.

Regions continued to place bonds for up to seven years in 2019, however more than half of these issues will be fully redeemed in no later than five years time. The average maturity of bonds placed in 2019 fell to 4.4 years, compared to 4.8 years in 2018, and 5.8 years in 2017.

Regions continued to place bonds for up to seven years in 2019, however more than half of these issues will be fully redeemed in no later than five years time. The average maturity of bonds placed in 2019 fell to 4.4 years, compared to 4.8 years in 2018, and 5.8 years in 2017.

Regions have lost interest in bonds mainly due to growth in budget income, which has reduced their need to resort to borrowing. The number of regions running budget deficits has almost halved compared to 2017. Account balances accumulated in recent years allow regions to finance deficits without raising funds through borrowing. Measures carried out by the Russian Ministry of Finance to reduce regional debt loads have also been effective.

Regions preferred to take out bank loans as interest rates fell throughout 2019. Regions have practically no opportunities to carry out early repayment of bonds. Bank loans are more flexible from this point of view because they can be paid off in ahead of schedule should interest rates fall and then be replaced by much cheaper loans.

It will still be possible for regions to switch from commercial debt to bonded loans in 2020, although a significant increase in the volume of placements is unlikely. Despite this, provisions added to the Budget Code of the Russian Federation in mid-2019 to ensure control over the debt load of regions and municipalities, and the stabilization of interest rates at their current low level may contribute to a certain increase in bond placements.

This year up to RUB 310 bln of sub-federal bonds are expected to be issued, judging by regional budget laws. In 2019 and 2018, regions planned to issue bonds with a total nominal value of RUB 250 bln and RUB 330 bln, respectively. However, the actual volume placed was 2.53 times lower around RUB 100 bln. This trend is most likely to continue in 2020, with offerings of sub-federal and municipal bonds in line with 2018 and 2019 levels.

Nevertheless, there are several factors that could contribute to an increase in the volume of bonds issued in 2020. First and foremost, stabilization of interest rates at their current level would result in fewer regions forgoing bonds in favor of bank loans. Furthermore, long-term bonds could serve as an instrument for covering possible growth of regional budget expenses to finance investment projects to develop infrastructure (which involve an extensive return on investment period). The lack of limitations on the cost of borrowing could serve as an additional driver of the possible growth of the regional bond market.

Starting from 2020, the size of regions and municipalities annual payments to service and repay debts will be taken into account when assessing their debt sustainability. Refinancing bank loans using bonds, which usually have maturities that are two times longer than bank loans, will reduce the annual volume of such payments and lower the risks associated with refinancing.

Key conclusions from the report are available in the videо.