The report «Russia-Egypt: cooperation trajectory» was prepared by the team of authors of the HSE Center for African Studies and the Center for International Trade and Integration with the support of the Roscongress Foundation for the XXV St. Petersburg International Economic Forum, in which Egypt takes part as a guest country.

Instability in the main food markets has greatly increased the importance of Russian-Egyptian economic ties.

Speaking about investments, it should be noted that as of 2022, 470 Russian companies operate in the Egyptian market, their investments amounted to about 8 billion dollars. Most of these investments come from Rosneft. However, in the case of Russian-Egyptian relations, food can compete traditionally important energy. At the end of 2021, trade increased by 4% and amounted to $4.8 billion. Egypt remains Russias largest trading partner in Africa, accounting for more than 30% of Russian trade.

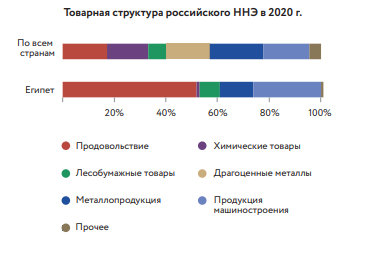

Russian exports to Egypt in 2021, according to the Federal Customs Service, amounted to $4.2 billion ($4 billion in 2020, $5.8 billion in 2019, $7.1 billion in 2018). The structure of Russian exports is dominated by grain supplies 37% of the total volume, copper, and products from it 10%, wood and products from it 9% and «other goods» 8%. The threshold of 5% was also overcome by fats and oils, as well as ferrous metals. Imports from Egypt to Russia in 2021 reached a record high in the history of bilateral trade $ 0.59 billion. The bulk of imports are fruits (49%) and vegetables (28%). Egypt plays an important role in the supply of potatoes to Russia (58% of imports in 2020). Egypt traditionally ranks second among African countries in terms of Russian imports (after South Africa). In general, in the structure of Russias non-commodity non-energy exports to Egypt, the share of food is more than 50%, which is more than 2.5 times higher than the average.

A promising direction for intensifying Russian-Egyptian relations could be the implementation of the Russian Industrial Zone project.

An agreement on the creation of a Russian industrial zone on the territory of the economic zone of the Suez Canal for a period of 50 years was signed at the 11th intergovernmental commission Russia-Egypt in May 2018. It is planned that Russia will be assigned a territory of 100 hectares, 2 kilometers from the quay East Bank of the Suez Canal (Port Said East). At the moment, the marshy soil is being prepared for construction. At the first stage of the project, the Russian Government plans to invest 12 billion rubles. through the Russian Direct Investment Fund within the framework of the national project «International Cooperation and Export».

Among the anchor residents are Transmashholding (already supplying railway cars to Egypt), PJSC Gazprom Neft, as well as the EFKO group of companies (already supplying oils to Egypt), which plans to build an oil and fat terminal on the territory of the RPZ. According to the website of the Russian Industrial Zone, 29 Russian companies have already shown interest in the project.

One of the main issues of future Russian-Egyptian relations is the liberalization of trade.

For cooperation in the EAEU-African Union format, Russian-Egyptian relations play a pivotal role: it is important to make further efforts to develop success in this systemically important area, including developing a partnership in the Egypt-EAEU format.

Both Russian and Egyptian experts note that despite the significant progress made, the potential for the development and expansion of Russian-Egyptian economic ties is far from being exhausted. Thus, new prospects will be opened by the liberalization of tariff (primarily by Russia and the EAEU) and non-tariff (primarily by Egypt) restrictions. The revision of tariff and non-tariff restrictions stimulates the growth of mutual trade, especially Egyptian exports, which in the future will lead to a more balanced trade turnover.

An important task for the coming years and even months is to find solutions to improve the system of mutual settlements, switch to using national currencies and other payment units in settlements and move trade away from dollar dependence. This work requires coordinated efforts of exporters, importers, banks, and regulators, opening correspondent accounts of Russian banks in Egypt and vice versa.

We also invite you to familiarize yourself with other materials posted in special sections of the Roscongress Information and Analytical System Africa, Trade policy and Foreign direct investment dedicated to topical issues of international cooperation.