A study by consulting firm Arthur D. Little explores how energy companies can adapt to the mounting decarbonization agenda.

The Roscongress Foundation presents the salient points of the publication accompanied by fragments of broadcasts of relevant panel discussions from the business programme of international events held by the Roscongress Foundation.

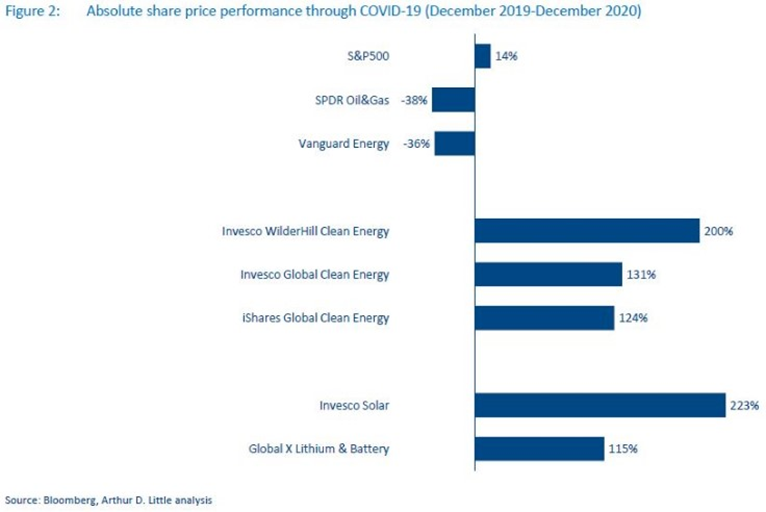

The pandemic has accelerated the growth in asset values of green energy companies amid lagging of traditional oil and gas companies.

Amid relatively weak oil prices since 2014, the global energy transition has been accelerated by the pandemic, which has highlighted the outstripping growth of green companies and the benefits of green business models. In terms of share price, natural monopolies, developers, independent energy producers, and solar and wind power equipment manufacturers have far outstripped their competitors in European stock markets in 2020.

The success factors in Europe were: good pricing conditions and the priority use of green generation, an increase in the number of wind and solar power plants, as well as the fact that about $ 350 billion of investments were attracted in the ESG sector, and the demand for green shares doubled in the past two years. State support, albeit limited, in the form of recovery aid packages, which included subsidies for renewable energy producers, was an important factor, the authors note.

Experts note that the green agenda today is being promoted more at the corporate level than at the state level thanks to the development of ESG tools and the trend towards sustainable development.

The decarbonization agenda permeates corporate governance and forces managers to make decisions with an eye on their competitive position in terms of ecology and green assets.

Companies and investors strive to gain access to green projects and technologies by adopting special development strategies. Regulatory changes also play a role, affecting the trade component and distorting the valuation and profitability of companies along the entire value chain.

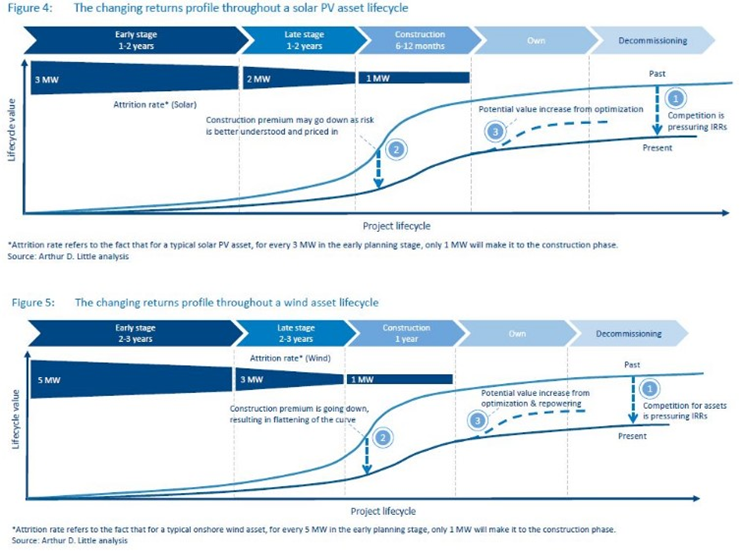

For infrastructure and energy companies, the most profitable today are investment projects from scratch (greenfield investments), which create the maximum added value over the life of the asset, as opposed to buying projects at a late stage or already ready for implementation. However, the competition in this field is most intense. Unlike conventional investing with a 5-7% rate of return, greenfield investments can bring double-digit returns.

In addition, the authors of the study detail the strategies of companies to acquire green assets to participate in the decarbonization agenda, and provide examples of recent acquisitions and mergers in the field of wind and solar generation. Ultimately, Arthur D. Littles research provides the company and management with a matrix of questions developed with a glance at the fundamental drivers and key trends in the energy transition, which allows them to develop the necessary strategy and follow it.

For more information, see the special sections of the Roscongress Foundation Information and Analytical System: Sustainable Development, Environment, Power generation, dedicated to the development of the environmental protection and decarbonization agenda, as well as the adaptation of the energy sector companies to it.