ILM experts present a market report of office property in Moscow for the Q1 and Q2 2020. The report covers such indicators as commissioned office space area, absorption of office spaces, vacant areas, average basic rental rates, etc.

The Roscongress Foundation presents the salient points of the publication accompanied by fragments of broadcasts of relevant panel discussions from the business programme of international events held by the Roscongress Foundation.

Following H1 2020 results, twice less areas were commissioned as compared with last year.

Following H1 2020 results, 5 objects with total office area of 61 ths. sqm (twice less than compared with last year) were commissioned in total.

If in the Q1 adverse effect of external factors did not have such significant impact on the market, and the number of new offers amounted to 45 ths. sqm, lockdown, including shutdown at the new sites, has led to decrease in new developments by 16 ths. sqm in the Q2.

The authors note that a trend of partial or full disposal of property as of its commissioning, will continue.

Following the results of two quarters, companies using office areas have shown a downward trend in activity. Net absorption showing changes in the occupied office areas, was equal to 6.4 ths. sqm, that is 175 ths. sqm less as compared with the last year.

Following the H1 results, vacation of premises in all property kinds in the Q2 2020, resulted in a negative value of total net absorption. Due to the coronavirus pandemic, for the purpose of cost saving, many companies have started to vacate occupied premises and transfer their employees to work from home or sub-leasing part of their premises. In terms of falling demand, net absorption for all property kinds in the last three months amounted to 92 ths. sqm.

Despite negative value of net absorption rate, deals for rent and acquisition of larger areas are still effected at the market. Majority of such deals is effected with office spaces in shell condition, therefore, actual vacation of currently occupied premises will occur later and shall lead to additional negative impact on net absorption rate.

Video:https://roscongress.org/sessions/promyshlennye-klastery-regionalnyy-aspekt/search/#00:37:02.592

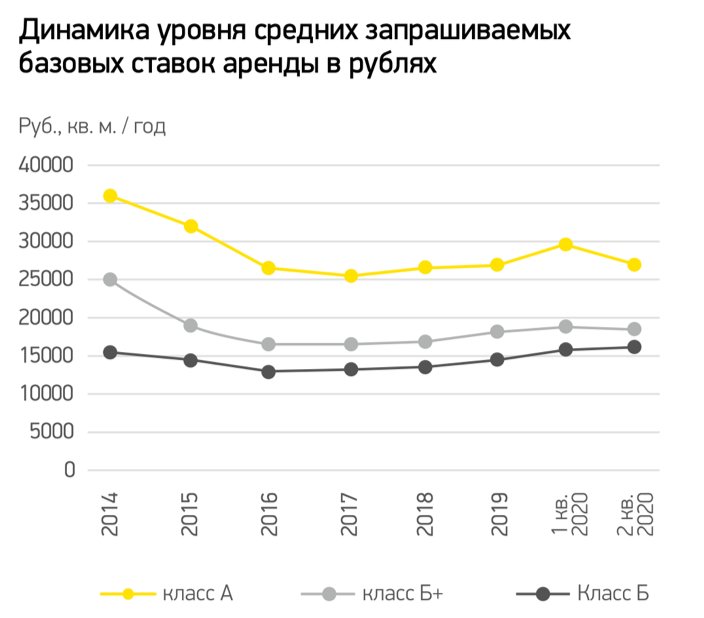

Average basic rental rates shown an increase in Q1 2020. In Q2 2020 the trend changed, as the pandemic impact has led to the owners shifting to a more flexible policy towards the tenants.

Average basic rental rates shown an increase in Q1 2020 that is firstly caused by change in the offer structure: the most in-demand premises at attractive business terms were sold or leased out. Average rate was also adjusted due to lower Russian ruble exchange rate.

However, the trend changed in the Q2. Having understood the pandemic impact, the owners shown more flexibility towards the tenants.

Nevertheless, high-quality property demonstrates a low level of free areas, while the property owners are not ready to drastic decrease in business terms. Many major property owners also continue to maintain rental rates at the pre-crisis level.

For more information about construction as a sector with a sizeable share in many economies, rising level of digitalization, and shifts in consumer sentiment in real estate, please see the Housing and Utilities, Building and construction and StayHomeEconomy.