The Center for Strategic Research (CSR) presents an in-depth study of business environment in the tourism industry. The publication reveals hidden barriers and potential drivers of growth, studies market sentiment, and suggests priority strategies.

The Roscongress Foundation presents the salient points of the publication accompanied by fragments of broadcasts of relevant panel discussions from the business programme of key international events held by the Roscongress Foundation.

Russia is ranked 39th in the Travel and Tourism Competitiveness Index 2019 rankings

Today, the travel and tourism industry (T&T) is a global economic power. According to the World Travel & Tourism Council (WTTC), the sectors contribution to the global economy (direct and indirect) in 2018 was USD 8.8 trillion, or 10.4% of the global economy.

The industrys contribution to global employment was 319 million jobs, or 1 in every 10 jobs. WTTC forecasts that by 2024 the sectors share in global GDP will grow to 10.8% (USD 13 trillion) while the contribution to employment will reach 10.8% (371 million jobs).

In Russia, the contribution of the tourism industry to the economy is less substantial. The share of tourism in Russias GDP was 4.2% in 2018 (USD 78.6 billion, or RUB 4,926 billion). According to a joint forecast by WTTC and Oxford Economics, by 2024 the share of tourism in Russias GPD will increase to 5.1%, with a growth of 51% in nominal values (reaching USD 118.95 billion) and 16% in real values (reaching USD 90.62 billion). Employment in tourism is projected to reach 5.1%, or 3.6 million jobs, by 2024.

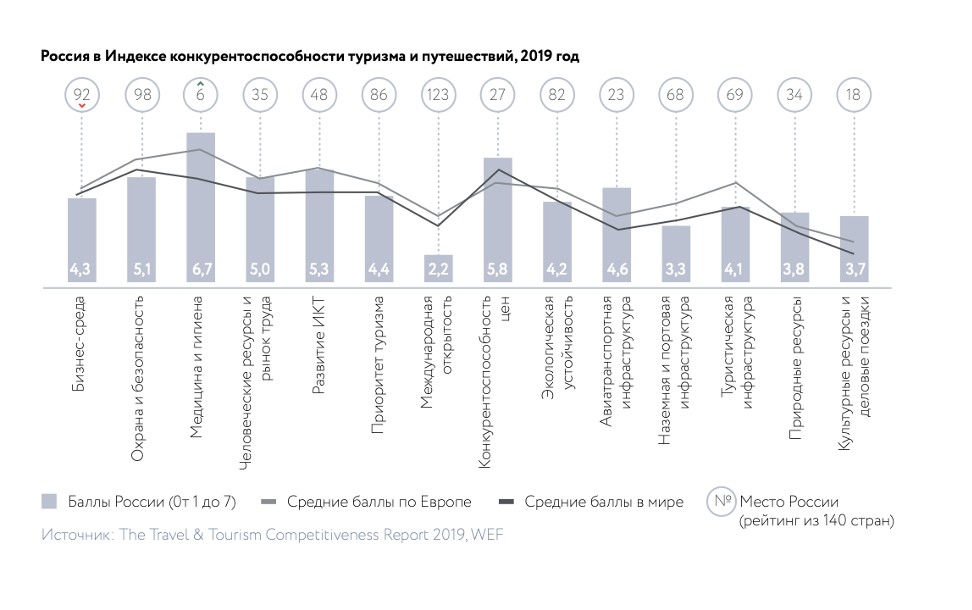

One of the most well-known instruments for measuring the T&T competitiveness of economies is the Travel and Tourism Competitiveness Index (TTCI) produced by the World Economic Forum (WEF). In the Travel and Tourism Competitiveness Report 2019, Russia is ranked 39th of the 140 economies assessed a comparatively high position.

Russia managed to attain this position because of its high level of health and hygiene (6th position globally), price competitiveness (27th globally), and accessibility and quality of cultural and natural resources (18th and 34th globally, respectively). The TTCI Report 2019 makes a special mention of the quality of Russias air transportation infrastructure (23th position globally) which accounts for the greatest share of Eurasias air traffic.

Russia is an attractive destination for inbound tourism

According to the United Nations World Tourism Organization (UNWTO), Russia ranks among the top twenty countries (of 140 assessed) by the number of inbound tourist trips. However, over the last five years, the level of tourist flow has remained practically unchanged (approximately 25 million trips). The greatest number of trips over this period was registered in 2015 (nearly 27 million). After that, in 2016, there was a decline followed by a stagnation. The FIFA World Cup in 2018 changed the country structure of inbound tourist flow, but not its volume which stayed practically the same.

Since 2014, there was a steady growth in the number of tourists from South Korea (CAGR 14/19 30%), Thailand (29%), Mongolia (19%), and China (17%). Indonesia, Cuba, and Hong Kong should also be mentioned as countries with an average annual growth of over 15% in the number of tourist trips to Russia. However, for none of these countries the number of trips to Russia exceeded 30 thousand in 2019.

At the same time, some countries show a constant decrease in the tourist flow to Russia. Since 2014, there was a nearly three-fold drop in the number of Russia-bound tourist trips from Uzbekistan and Turkey. Importantly, the tourist flow from Poland, Finland, and Belarus is also decreasing, although these countries have traditionally strong historical and economic links with Russia. The reduction in tourist flow should prompt industry players to search for a reason why Russia has become a less attractive destination for tourists from these countries.

Video: https://roscongress.org/sessions/rossiya-vybor-turista-chego-ne-khvataet/search/#01:36:35.840

Outbound tourism figures in 2020 will undergo a dramatic change because of the COVID-19 pandemic coupled with ruble depreciation after the OPEC+ deal collapse

After a decrease in 2015-2016, the number of outbound trips from Russia in 2019 increased to 45.3 million compared to 42.9 million in 2014. The negative trend in 2015-2016 was caused by foreign policy developments and a resulting depreciation of the ruble which made foreign travel less attractive for Russians. The subsequent stabilization of the national currency and adaptation to foreign policy shocks led to a new wave of growth in foreign travel popularity.

Due to the specifics of statistical recording its hard to make an accurate estimate of the share of people who travel abroad. Surveys show that the share of Russians who traveled abroad in the last four years is approximately 6-10%.

The authors of the publication point out that outbound tourism figures in 2020 will undergo a dramatic change because of the COVID-19 pandemic coupled with ruble depreciation after the OPEC+ deal collapse.

Video: https://roscongress.org/sessions/spief-2019-invest-sessiya/search/#00:57:21.663

Russian tour operators report an upward trend in the popularity of domestic travel destinations in 2019

CSR analysts estimate that the number of Russian tourists staying in Russian lodging accommodations increased by 60% since 2014, reaching 62.2 million people. Such a rapid growth is explained by a number of reasons:

· growth in popularity of domestic travel with accommodation in hotels and similar lodging accommodations;

· revitalization of the system of health resorts against a background of general buoyancy of domestic tourism;

· renovation of old health resort facilities;

· changes in the structure of outbound tourist flow with a shift towards domestic destinations;

· massive movement out of the shadow economy (this trend was particularly noticeable in 2015, when the number of newly registered lodging accommodations grew by 29% in a year);

· active development of low-price accommodations, especially guesthouses and small inns;

· a shift in demand towards lower priced segments which resulted in a 20% decrease in average overnight price.

One of the barriers to T&T industry growth in Russia is the poor quality of tourist infrastructure. First and foremost, tour operators are concerned about the state of the roads and a shortage of interregional air travel routes. Also, low compliance with safety rules and obsolete facilities and safety equipment are often mentioned as problems.

Poor quality of communications service and internet connection outside large cities is often cited as one of the biggest barriers to industry growth. For example, in the Siberian and the Far Eastern Federal Districts this fact hinders travel to unique but out-of-the-way places of natural beauty.

Despite the barriers, however, tour operators observe a trend towards a growth in the popularity of domestic travel destinations and availability of new services.

Besides the topics discussed above, the publication provides an integrated assessment of the state of the T&T industry, reviews key market players, evaluates Russian tour operators, and assesses the quality of the tourism infrastructure and the potential of Russias T&T industry.

For more information about policy responses to the coronavirus outbreak and possible ways to stabilize the economy during the pandemic, please see the COVID-19 and StayHomeEconomy special sections of the Roscongress information and analytical system.