In this publication, the Institute of Natural Monopolies Research (IPEM) summarizes the performance of Russias manufacturing industries in March 2020.

The Roscongress Foundation presents the salient points of the publication accompanied by fragments of broadcasts of relevant panel discussions from the business programme of key international events held by the Roscongress Foundation.

Demand in extractive industries dropped in March 2020

Against a backdrop of stagnation in global manufacturing, a drop in global oil demand due to the coronavirus pandemic, seasonal surplus, and a lack of unity in OPEC+ concerning new oil production cuts, the price for Urals oil grade reached a new minimum, with pipeline run price for Northwestern Europe countries falling to the lowest value of June 1999 (USD 12.79 / barrel).

In March, Gazproms gas export to Europe continued to decrease (-17.7%) due to a range of factors such as an exceptionally warm winter, large volumes of gas in gas storage facilities, and a general economic deceleration in the EU caused by the anti-epidemic restrictions.

Coal exports in March continued to fall as well (-6.8%) due to a reduction in global demand for coal caused by, among other things, a decline in energy consumption in Europe and Asia. The sharpest drop in demand since the beginning of the year was registered in the UK (-81%), Turkey (-40%), France (-28%), India and China (-11% each). At the same time, the sector managed to attain a three-fold growth in exports to Germany, Vietnam, Thailand, and Belarus, and a two-fold growth in exports to Latvia and Kazakhstan. Furthermore, the sharp fall in gas prices in long-term contracts in Europe and Asia following a slump in oil prices can further weaken the competitiveness of coal in power generation against other fuels.

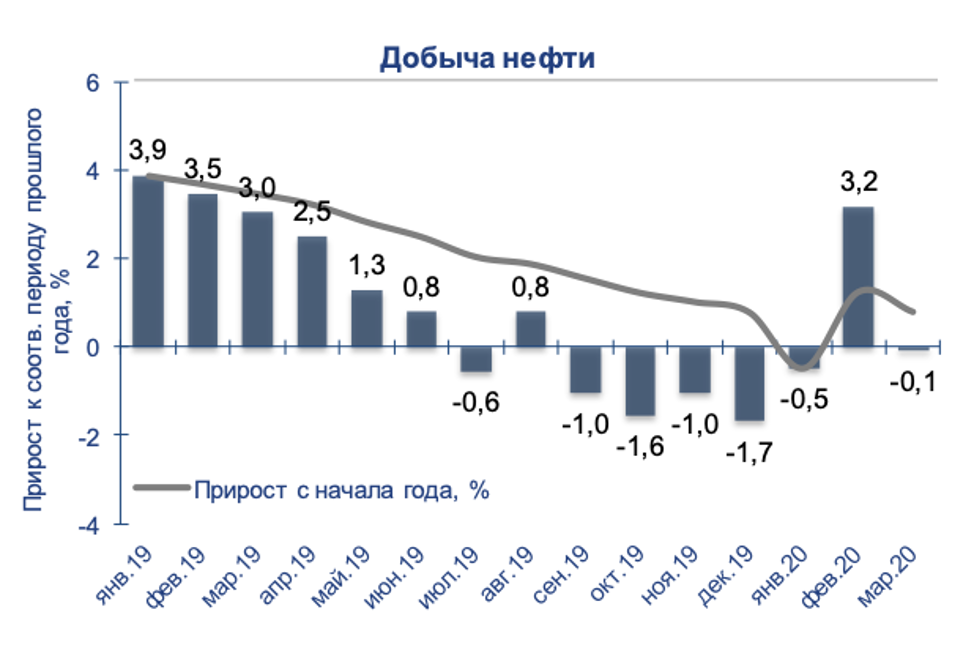

Oil mining decreased by 0.1% in March 2020 compared to March 2019, while oil exports decreased by 6.0%. Gas extraction dropped by 12.3% in March 2020. Gazproms gas export to non-CIS countries declined by 17.7% in March 2020. Coal mining decreased by 10.1% year-on-year, and coal exports by 6.8%.

In low-tech industries there was a considerable growth in demand in March 2020

The demand growth in the low-tech sector was primarily caused by the upward trend in food industry resulting from the epidemiological measures and the rise in demand for some food and non-food products. Also, the forced restrictions on imports of some products made a certain contribution to industry growth. Statistics by Rosstat show that in February 2020 food production increased by 9.5% year-on-year.

In March 2020, a range of new large production facilities were launched:

in Tula Region, Miratorg launched the first phase of a sheep breeding project (with total investments of RUB 6 billion);

in Penza Region, Rusmolco launched the first production line of a milk-producing cluster with 5200 heads of livestock (RUB 4.5 billion);

in Bashkiria, the first production line of Pobeda milk products plant was officially opened (RUB 2.3 billion);

in Belgorod Region, GK EFCO opened an enzyme production plant (RUB 0.76 billion);

in Ivanovo Region, a large dairy plant with 1200 heads of livestock was launched (RUB 0.7 billion);

in Smolensk, work at Rosa dairy plant was recommenced (RUB 0.3 billion);

in Khabarovsk Territory, a new plywood production plant was opened (RUB 0.23 billion).

Demand in medium-tech industries shrank in March 2020

Nearly all medium-tech industries see a decrease in demand for their products. Domestic demand for ferrous metals shrank by 11.8% in March (-6.9% between January and March 2020). Export of ferrous metals in 2020 followed the downward trend of 2019 (-9.6%, −9.5%).

Demand for non-ferrous metals dropped in March 2020 both on the domestic (-30.6%, −14.2% between January and March 2020) and the external market (-19.5%, −6.4%). Currently, the key factor that pushes down the demand in the sector is the consequences of the anti-pandemic restrictions which have had a considerable impact on production centers both in Europe and Asia. At the same time, protective tariff policies of metal products consuming countries remain relevant as well. Also, in late March the Ministry of Economy of Mexico announced a new wave of anti-dumping investigations concerning imports from Russia.

The negative trends in the sector are reinforced by the continuing decrease in exports of chemical and mineral fertilizers (-5.5%, −9.2% between January and March 2020), although domestic demand for fertilizers was supported by seasonal processes related to spring agricultural works (+13.1%, +14.3%).

Video: https://roscongress.org/sessions/geologiya-budushchego/search/#00:18:26.431

Demand in high-tech industries shrank in March 2020

Loading volumes of machine building products on the rail network continued to decrease in March 2020 (-15.8% year-on-year, −16.3% between January and March 2020). A steady decline in loading volumes is observed both on the domestic (-13.6%, −16.3%) and the external market (-36.1%, −16.1%).

Car production continues to decrease. According to Rosstat, in February 2020 production fell by 12.0% (-14.1% between January and February 2020). Given the current difficult situation in rail freight car building (oversupply on the market, declining demand), freight car production in February 2020 decreased by 3.3% (-1.6%). However, positive trends are observed in passenger car production (+25%, +20.1%).

Besides the topics discussed above, the publication provides export and import indices and offers an analysis of performance indicators for oil mining, gas extraction, coal mining, and power generation industries.

For more information about policy responses to the coronavirus outbreak and possible ways to stabilize the economy during the pandemic, please see the COVID-19 and StayHomeEconomy special sections of the Roscongress information and analytical system.