An escrow account is a special type of bank account held with a bank called an escrow agent. The mechanism of construction financing using an escrow account works in such a way that the money from buyers goes through an escrow account instead of coming directly to the developer. When making a shared construction participation agreement, the homebuyer pays a sum of money into a special account where the money remains deposited up to the moment the apartment is commissioned and property rights are registered. This mechanism reduces the homebuyers risks associated with construction freeze or developer bankruptcy.

While the mortgage rate without an escrow account is fixed (10-12%), with escrow accounts the rate is adjustable and is defined at a given moment using the following formula: (4-6% (min) * share of loan collateralized with the money in the escrow account) + (10-12% (max) * share of loan not collateralized with the money in the escrow account).

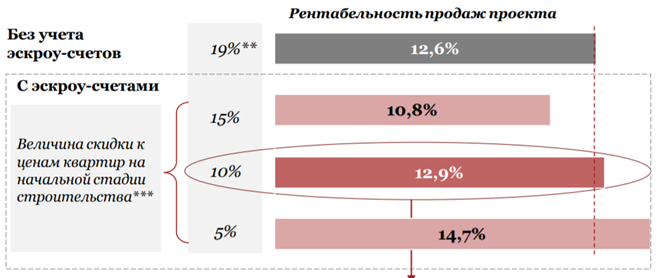

As a result of the transition to the mechanism of using escrow accounts when selling housing property, the cost of construction will increase by 3.8% compared to the base scenario.