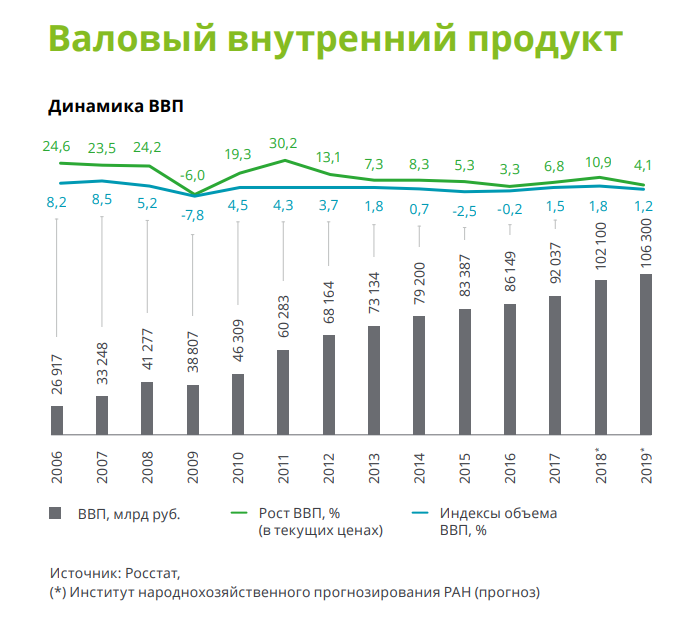

The data published in the Russia in Figures section show that the dynamics of economic activity indicators were in line with the forecast of the Bank of Russia that expects GDP growth of 1.5-2 percent in 2018. In October, the growth accelerated to 2.5 percent. The Deloitte experts believe that the increase was primarily due to an acceleration of agricultural and industrial production and a growth in the volume of construction work.

In the period from January to October 2018, foreign trade turnover increased by 20% year on year; exports increased by 28.2%, and imports by 7.3%. The publication also provides a breakdown of export and import figures for various categories of goods.

Citing the Central Bank of Russia, IEF RAS, the Ministry of Economic Development, and the Economist Intelligence Unit as sources, Deloitte gives forecasts for currency rates and the Central Banks key rate up to 2020.

Inflation rate in 2018 was slightly higher than forecast and reached 4.3%. The share of external debt in reference to GDP has decreased from 33% to 29%. Household finances demonstrate steady levels. According to data provided by Rosstat, average monthly nominal salary has increased, as well as the volume of mortgage loans in rubles and other individual loans.

In addition, the Russia in Figures section provides pricing dynamics for main commodities, such as nickel, copper, gold, aluminum, oil, and gas.

The Research Centre section of the journal offers the results of a survey of Chief Financial Officers (CFOs) of leading Russian companies. The respondents were asked to assess the financial situation in their company in 2018. In 2H 2018, the expectations of CFOs regarding financial prospects of their companies became more pessimistic. Many respondents expect that operating costs in their company will grow while revenues will decline. The journal also reviews current HR strategies and development strategies and offers insights into CFO social media personality profiles.

The Russian Manufacturing Sector section of the journal describes the current state of the sector and gives an outlook for its development. Expectations regarding the manufacturing sectors outlook are generally positive though somewhat subdued when compared to the previous year.

The journal also contains an overview of the steel and iron ore market. According to the World Steel Association, global steel production and consumption growth continued in 2018, albeit not as rapidly as before. However, the growth in 2018 was faster than in 2017. The current trade policy creates risks for the forecasts, mainly associated with the US trade tariffs.

The final section of the journal lists Top 5 Mergers & Acquisitions of Russian companies and gives a digest of global news.