Igor Sechin, Chief Executive Officer of Rosneft Oil Company, presented the keynote speech «The Flood on the Energy Market. The Second Abduction of Europa» at the Special Session of the 15th Verona Eurasian Economic Forum.

Dear Forum participants and guests,

I am glad to welcome you at the XV Eurasian Forum, this time in Baku, not in Verona, which is somewhat closer to the center of Eurasia.

I am in a difficult position — the previous speakers have told you everything I wanted to report. So I will refer to the verse of Vladimir Mayakovsky, which he wrote 100 years ago.

You can only have faith in the future

If you see how a powerful flood

Fills the hearts of capital cities

With Bakinian

oily

thick

blood

V. Mayakovskiy

Today we have gathered at this respected venue, in the cradle of world and Russian oil and gas production, the city that remembers the Nobel brothers and Gadzhi Tagiyev, Dmitry Mendeleev, Vladimir Shukhov, Ivan Gubkin, academician Yusif Mammadaliyev, Farman Salmanov, who has become the most successful geologist in the world due to his discoveries, the legendary Khoshbakht Yusif-zade, who is still working in SOKAR, outstanding entrepreneurs, geologists, engineers-inventors, who created the world oil and gas industry practically from scratch here.

Today the Caspian production is experiencing its renaissance due to new technological capabilities, mastering of deep-water drilling, filigree work with formations, which allowed in the current conditions to create a major international center of oil and gas production, which plays a special role in the energy security of Europe. Since the beginning of the year, oil exports have increased by 60% up to $15 billion, and gas exports — by 22%. 27 European countries are purchasers of Azerbaijan’s oil, of which Italy came first, which is symbolic for our Forum (almost 39% of exports). European markets account for 51% of Azerbaijan’s gas exports. Azerbaijan is planning to almost double the capacity of the Southern Gas Corridor — from 16 to 31 billion cubic meters. The strategic approach of the Azerbaijani leadership, which creates special conditions for the development of the national oil and gas industry, deserves respect.

I am glad to welcome in person and online First Deputy Prime Minister of Azerbaijan Shahin Mustafayev, SOCAR President Ravshan Nadzhaf, Minister of Petroleum and Natural Gas of India Hardeep Singh Puri, Minister of Mining and Heavy Industry of Mongolia Ganbaatar Jambal, VTB Bank President and Board Chairman Andrey Kostin and ONGC Videsh Chief Executive Officer Rajarshi Gupta.

Particularly I would like to note our outstanding moderators: IMEMO RAS scientific director and president, academician Alexander A. Dynkin and Mr. Alessandro Cassieri, leading expert analyst of the most influential Italian TV channel RAI.

I would like to express sincere gratitude to Minister of Economy of Azerbaijan Mikayel Chingizovich Jabarov, whose personal attention and energy made it possible to organize today’s Forum in the shortest possible time. I would like to express special gratitude to our dear friend, Professor Antonio Fallico, President of the «Explore Eurasia» Association, head of the Moscow branch of Intesa Sanpaolo Bank for his meticulous preparatory work which preceded all our forums, including this one.

Of course we are sincerely grateful to President of the Republic of Azerbaijan Ilham Heydarovich Aliyev and our President Vladimir Vladimirovich Putin for supporting our work.

Disclaimer

Before we start the discussion I should of course mention liabilities limitation as my report has estimates and forward-looking judgments.

Let me start by quoting President of the Russian Federation: «Today the world is undergoing a profound transformation, entering a new period of upheaval and transformation ... These serious challenges make it clear to everyone that a multipolar world and true multilateralism are the only true path for humanity».

Indeed the global ongoing transformation is probably the largest tectonic shift for the humanity for at least a century.

I would like to note that neither the pandemic nor the Ukrainian crisis, nor energy and economy problems in general is the root cause of the ongoing global tectonic changes — objective process of the global regulator change — the hegemon who arbitrarily appointed himself as such, making up his own rules for the rest of the world and arbitrarily changing them as soon as they become disadvantageous to him. It should be understood that the United States are forced to fight to maintain their hegemony at all costs and cannot afford surrendering in this struggle, because the loss of hegemony — financial, military, political and economic one — means for them the impossibility of reproducing themselves as a country, economy and political system.

As U.S. Secretary of State Anthony Blinken said, speaking at Stanford University mentioned that if we are not the leader, then one of two things will happen: either it will be someone else and probably not someone who is not properly promoting the interests and values of the American people, or, equally bad, there will be no leader and then there will be a vacuum that is filled with chaos and jungle law before it is filled by anything else... And so during a visit to the Pentagon yesterday, President Biden said that: The United States will continue to lead, with diplomacy backed by the best fighting force in the world.

As a result of these concepts implementation politics has completely destroyed the economy. Energy market is the most vivid illustration to that: the sanctions pressure reaching its culmination, which has now turned into sabotage — to what happened to the European gas transportation system — Nord Stream.

There is no single energy market anymore. There are no rules. The high volatility that has been observed throughout the last decade has become unprecedented today. The trends that we outlined earlier and those that may manifest themselves suddenly act independently, do not absorb each other, completely destroying the foundations of law, private property and the market like a cumulative projectile.

Let`s list them one by one.

1. Sanctions are the destruction of the corporate law foundations, complete destruction of the market relations basics, refusal from contract obligations fulfillment under far-fetched pretexts with a complete lack of responsibility.

2. Arbitrary illegal seizure of assets from the sanctioned companies individuals and entire countries which in fact is the abolition of private property inviolability.

3. Undermining of the legal and judicial system basics as a result of the abolition of judicial independence. Circular letters from the White House and the European Commission are reproduced without change in the form of court decisions. Cynicism has reached the point where those on the sanctions lists are now deprived of the right to defend themselves with the help of lawyers.

4. Abolition of competition. Here is yet another European Union innovation — procurement centralization. Up to 15 percent of the gas purchased for storage in Europe is supposed to be purchased and distributed through the European central station which will now decide who and on what terms will be allowed to allocate resources.

The European Commission believes that the rise in gas prices is caused by the competition for suppliers. Until now, in market economics it was believed that suppliers` competition and supply sources diversification are the main tools for lowering prices.

In this regard, the speed of implementing any absurd proposal thrown in by the U.S. administration is astonishing. Jennet Yellen — U.S. Treasury Secretary — have just thrown in the idea of «ceilings» and diligent European functionaries have already taken up its implementation. «The European Commission is considering gas prices limitation depending on the level of relations with the supplying party» says European Commission head Ursula von der Leyen...

In essence, the introduction of ceilings is an attack not only on the fundamentals of the market, but also on the fundamentals of sovereignty. The essential idea is to abolish sovereign rights of countries to their own resources, because the «right» countries, which lack resources, need them more than the «wrong» ones. Of course, the U.S. itself is not affected by these restrictions. Although a number of experts and politicians in Europe are already openly accusing the United States of profiting from the energy crisis that they have provoked themselves — that is, from the problems of their allies. (Gas prices in the U.S. are five times lower than in Europe, to which they imposed their LNG).

Energy crisis

Ursula von der Leyen states as they say from the heart that «The cause of the energy crisis is not the rise in price of hydrocarbons, but the fact of their use». In other words the root cause of the crisis is the very fact of the need for energy resources for the population and industry. In short, the consumers are to be blamed themselves.

Basically, this is all there is to know about the «wise and responsible» energy strategy of Of the European Union officials.

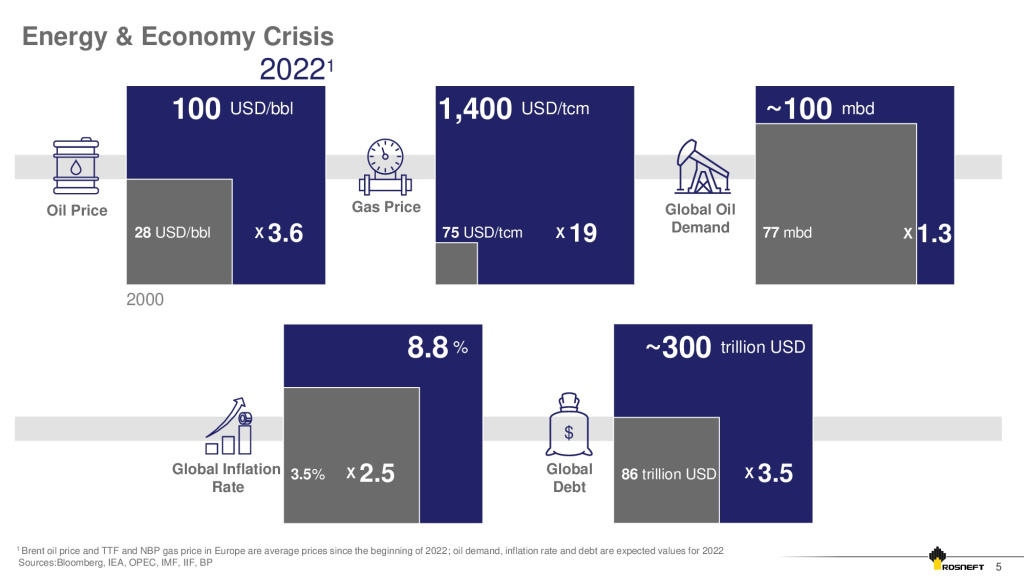

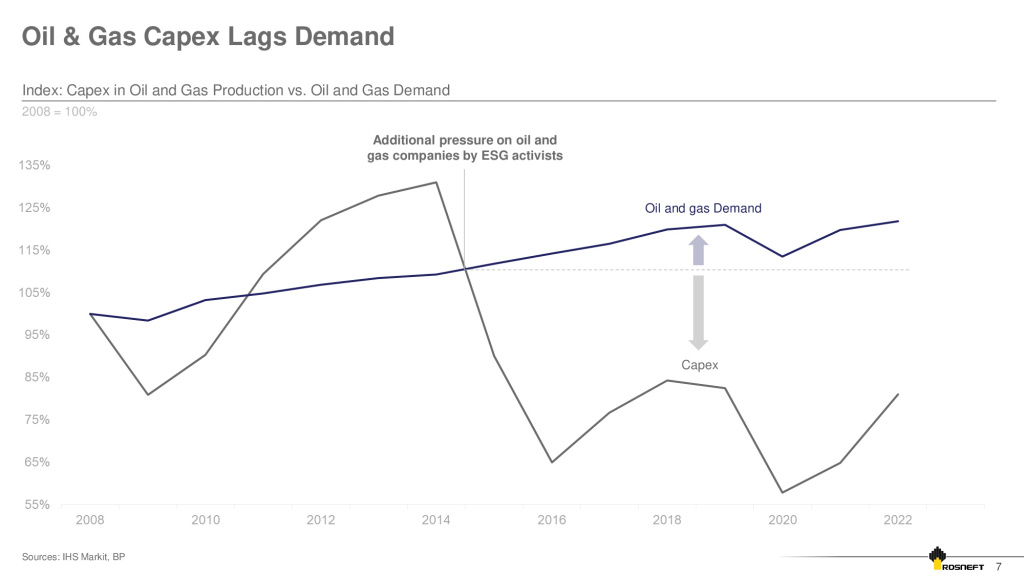

The sources of the current artificially created energy crisis are not the events in the Ukraine or the pandemic, but the enormous industry underinvestment, one of the causes of which is the irresponsible and adventurist policy of accelerated «green transition». And further anti-Russian sanctions as a powerful additional catalyst of the energy crisis and inflation in general. It is now clear that the «green transition» policy has nothing to do with solving climate problems. At present, the technologies necessary to implement a truly effective transition from conventional energy to low-carbon energy are not available.

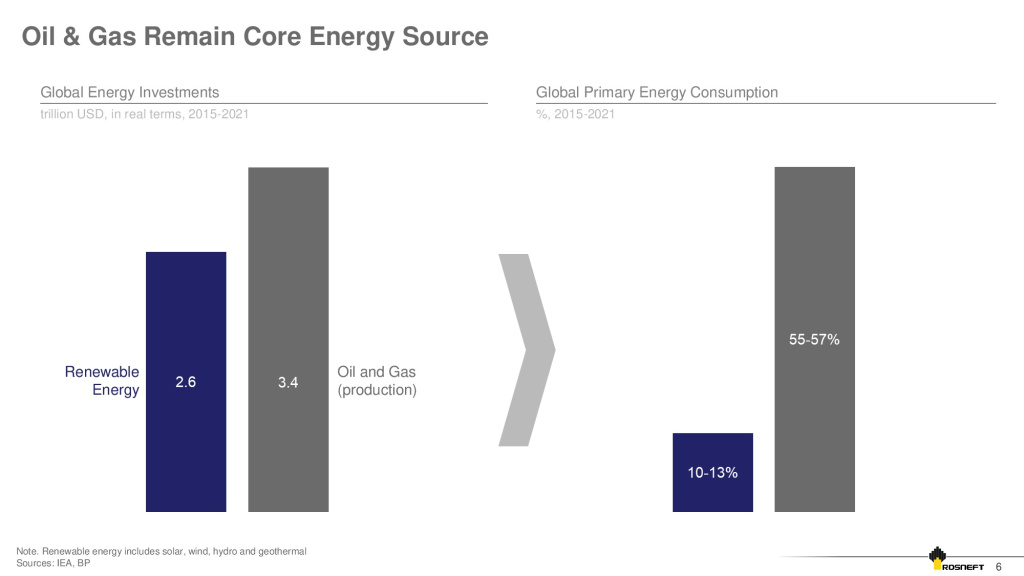

Oil and gas remain the world’s main source of energy, reliably supplying more than 50% of global demand. 36% is coal, and its share is growing for reasons you know. At the same time, huge investments in renewable energy, the amount of which over the past 7 years exceeded the incredible USD 2.6 trillion, did not bring results: the share of renewable energy during the same period grew by only 3 percentage points. Here lies the reason for underinvestment in conventional energy and the current state of the global energy market.

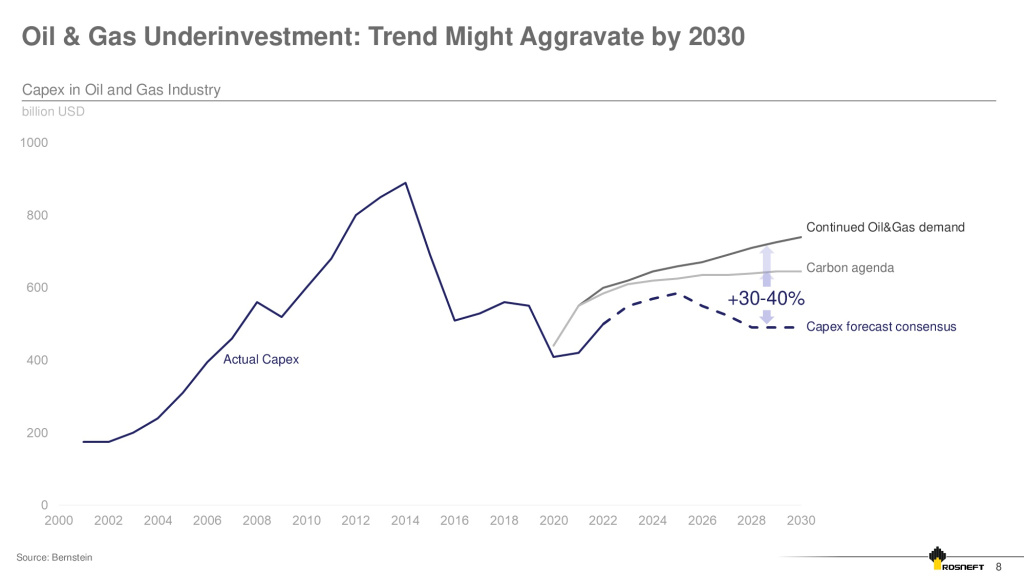

According to GOLDMAN SACHS analysts, previous years of significant underinvestment in the industry (from a peak of $900 billion a year to $300 billion in 2020) have resulted in the average proven global reserves availability reduced two times, from 50 to 25 years.

Insufficient exploration scope often no longer provides even simple replenishment. According to Rystad Energy analysis, global recoverable oil reserves and resources have declined by nearly 9% YoY (152 billion barrels) to 1,572 billion barrels by early 2022. Of these, only 1,200 bbbl (76%) would be economically feasible to develop at or above $50/bbl. The decline in the estimate of global reserves is due to a reduction of explored resources by 120 billion — this is just for the US offshore sector. Restrictions on federal land leases made by the regulator in order to support green programs contributed to the negative exploration dynamics.

The quantitative dynamics of gas reserves are alarming. According to OPEC, gas reserves-to-production ratio has been on a steady decline in recent years, reaching its lowest level since 1975 by 2021.

According to Rystad Energy estimates, in 2022 the number of license rounds for the right to use the subsoil and the area of the granted sites will decrease to their minimum values for the last two decades. In January-August 2022, there were only 21 license rounds worldwide, which is only half the number of tenders conducted during the same period last year, which was not very successful.

The accumulated lack of investment, as well as the rejection of Russian hydrocarbons, leads to acute energy shortages and prices increase, spinning an inflationary spiral around the world. At the same time, the leading European energy companies, despite the energy crisis in the region, continue to reduce investment in the oil industry under the pressure of climate policy. For example, Shell announced the complete cessation of exploration in new basins by 2025, and ENI intends to bring the share of gas in production to 60% in 2030 and 90% by 2040, reducing oil production.

On the other hand, amid high energy prices and rising industry profitability, many majors, including BP, which previously positioned themselves as leaders of green transformation, have dramatically changed their approach.

Today, BP is not just claiming a return of interest in both U.S. shale and North Sea offshore production, but has already begun offshore investments in the Alligin and Vorlich projects, which according to geologists together contain about 7 million tons of oil equivalent.

As a remark, I would like to inform our esteemed colleagues that despite the bright statements of BP’s Board of Directors on February 27 of this year about its decision to stop participating in the share capital of Rosneft, the company has not fulfilled its decision. And despite all the rhetoric, it continues to be a «shadow» shareholder. It does not participate in the work of the company’s management bodies and retains all rights and dividends corresponding to the stake. I would like to take this opportunity to inform our friends at BP that the $700 million in dividends due to them for the second half of 2021 were transferred to the accounts opened for them. Successful implementation of joint projects with BP is continued. For example, in September, despite the lack of funding from our partner, we launched Kharampur major gas project on time, which increased the Company’s production by 11 billion cubic meters per year.

To be objective, I would like to remind that the BP income from its participation in the equity capital and joint venture with Rosneft already amounted to $37 billion, while the total amount of cash investments was $10 billion. This is excellent compensation for the invested capital.

Unfortunately in the current environment, it became risky for many companies to invest in long-term projects. GOLDMAN SACHS estimates that the share of investments in oil and gas projects with a quick payback period has increased from 37% of all investments in the industry in 2010 to 60% today, but there are simply not enough of these highly profitable projects and they can’t meet long-term demand.

Another bright example of industry underinvestment. In 2021, the world’s refining capacity decreased for the first time in 30 years by more than 35 million tons per year. About 80 million tons/year was closed, converted to biofuel plants or import terminals, and the capacities put into operation amounted to only a little more than 40 million tons/year.

According to the forecast of J.P. Morgan, if the current investment trends persist, the global energy deficit observed in 2022 will increase sevenfold by 2030. To eliminate this deficit, investments in the conventional energy sector should be increased annually by an average of $100 billion by 2030, including $44 billion in the oil industry.

JPMorgan CEO Jamie Dimon told an investor meeting the other day that «ramping up oil and gas production is critical for the U.S. to maintain financial stability and independence and to keep the West united, and stressed that companies should not be turned over to ESG activists because ’some investors’ do not value ESG.»

Bernstein analysts believe that from now until 2030, oil and gas investments should grow by at least 20% on average. And if we aim to meet hydrocarbon demand growth at 1% per year, capex in 2030 should be 30% higher than it is now and 40% higher after 2025.

The Biden administration’s policy on fossil fuels and its public statements are not conducive to an investment-friendly environment, either. The White House may be demanding additional supplies from producers today, but its policy priorities are focused on eliminating the need for them within just five years. Such a time frame is extremely small for an industry whose investments often last 20 years or more.

Today, the Biden administration’s energy policy is solving exclusively electoral problems with a two weeks planning horizon (given that the elections for the U.S. Congress are on November 8). This includes attempts to persuade Saudi Arabia at least to postpone the announcement of this decision till the U.S. congressional elections.

And I would like to take this opportunity to express my respect for Saudi Arabia’s balanced position, free of political conjuncture, based on an objective analysis of the supply and demand balance and ensuring the stability of the world oil market...

Returning to the peculiarities of American politics today: this is the fourth time that the U.S. Treasury has postponed the budget deficit report. Before September, as you know, the FRS was cutting the balance sheet, tightening monetary policy. It is for that purpose that the rate was raised; and, suddenly we see a prohibitive increase in the deficit in September amounting to $365 billion (year-on-year the deficit grew to $430 bln). By comparison, in 2021 the deficit in September was $65 billion, and in the pandemic year of 2020 it was $125 billion.

What else could have forced the administration to turn its budget policy so drastically? In fact, it is mainly student loans: 400 of the $430 billion — 22 million potential borrowers — that is simple vote-buying. Where is the Ukraine, where just over 16 billion is really spent? And that, for the most part, is supply from the availability of the U.S. military and its allies.

Financial Darwinism

The FRS and the U.S. dollar which is currently the world’s dominant reserve currency have remained a traditional instrument of manipulating the global market along with sanctions.

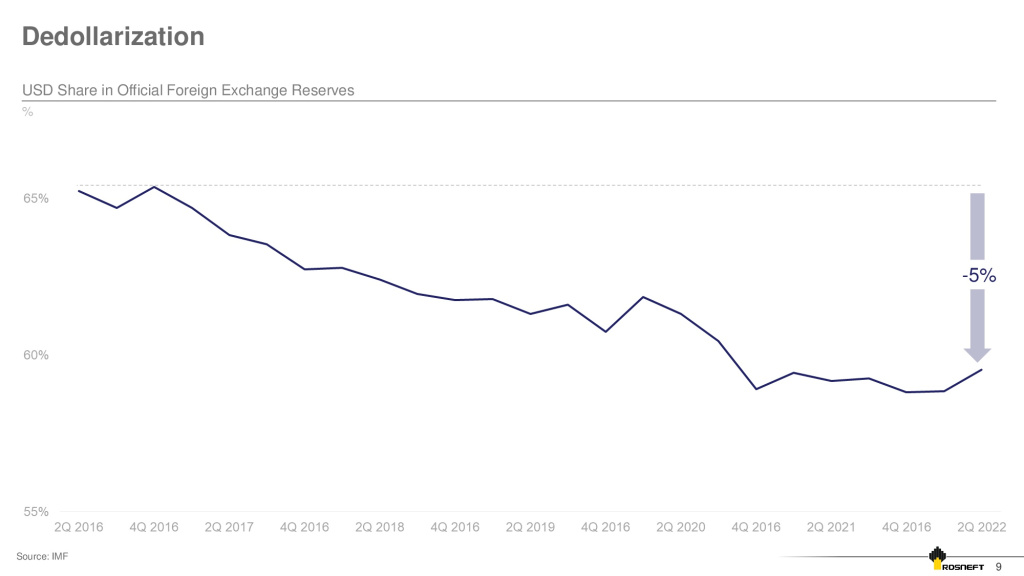

Since the end of 2021, foreign investors have reduced investments in U.S. government debt by $238 billion. The U.S. dollar’s share in foreign exchange reserves of the world countries’ central banks fell to 55%, the lowest level since 1995.

Dollar is strengthening in U.S. allies, of which there are enough, at least for now. But it is not the whole world. The major economies of Southeast Asia are more and more often settling accounts directly with each other. Central banks in Asia and the Middle East are creating bilateral currency swap lines with the intention of strengthening their own financial systems and reducing the risks of dependence on the dollar, amid arbitrary seizure of accounts, transactions, sovereign funds and foreign exchange reserves. We are witnessing the desire of the states that want to maintain their sovereignty to move away from the settlement of accounts in dollars. This process has been launched and it is irreversible.

I would like to quote Zhang Yugui from Shanghai International Studies University: «America’s trump cards for strategic advantage remain only armed forces, financial strength, and the support of a group of high-tech companies. That is why the Fed’s monetary policy is the basis of Washington’s economic strategy.»

I will try to clarify this thought of the Chinese researcher, formulating as follows: the American trump cards used by the United States to create strategic advantages are the use of the entire U.S. credit and financial system and all the high-tech companies` capabilities along with the armed forces to achieve the required results. The situation with STARLINK is one of the examples. We have already referred to the book «Treasury Wars» by Juan Zarate — read it...

The world has changed, it has changed for everyone, including the United States. And the resource that they gained in the last century as the issuer of world currency, the ability to influence billions of the earth population through the control over global network, thanks to which they believe in their omnipotence, this resource is ending. Civilizational algorithms have led to the development of other influence centers. Today it is no longer possible to ignore the positions of China, India, Russia...

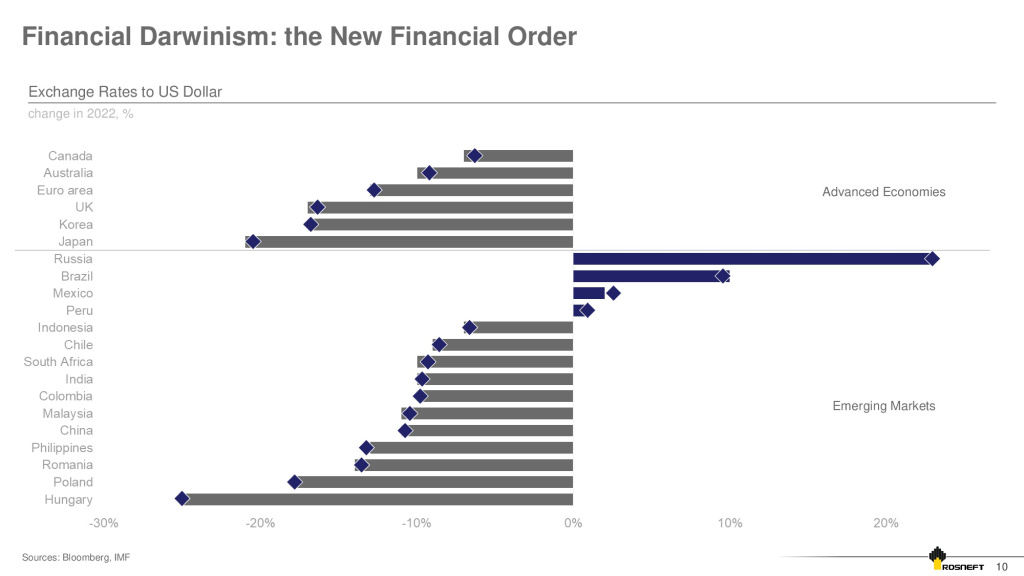

The United States continue to exploit its financial resource, but the efficiency is steadily decreasing. Today they are best able to use this resource effectively, including manipulating the dollar in relation to their allies. For example, the yen, pound and euro suffer most from the FRS policies today. They are the ones who are in danger of burning in the flames of the crisis in order to save the dollar.

Zoltan Pozhar, analyst at Credit Suisse, published a report that is now widely quoted, generally without reference and not always correctly. What is Pozhar talking about? He states the collapse of the low inflation period, which allowed the so-called «monetary easing,» that is, unlimited dollar emission, which provided a sort of free prosperity and a simple solution to all problems.

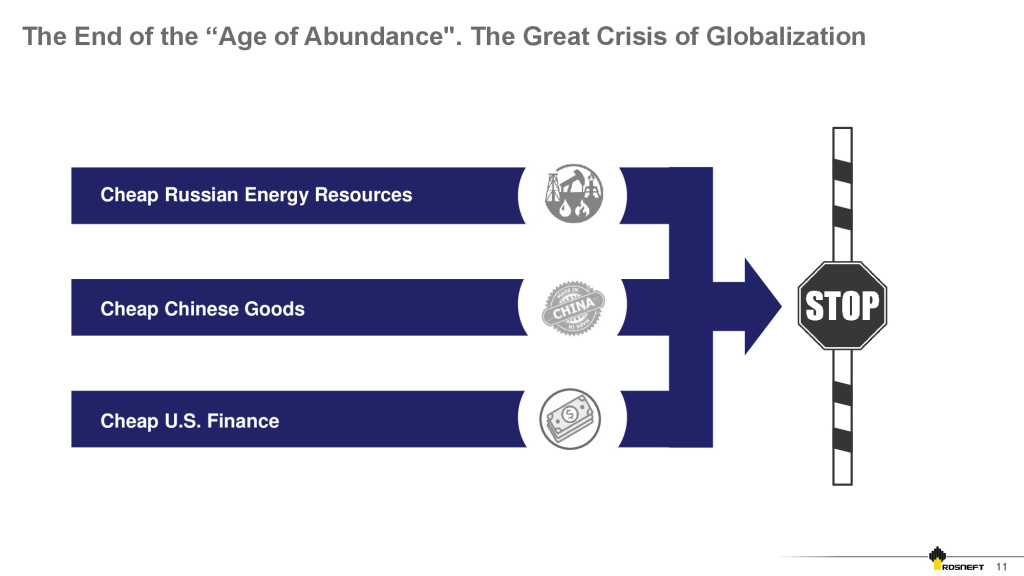

That is, simply put: cheap Russian energy, cheap Chinese goods, cheap U.S. money. At the same time China and Russia duly converted their income into U.S. debt, practically financing the U.S. budget deficit and absorbing the emission of dollars.

Pozhar underscores that 20 billion of Russian energy imports allowed Germany to create 2 trillion dollars of value added!!! «100x leverage».

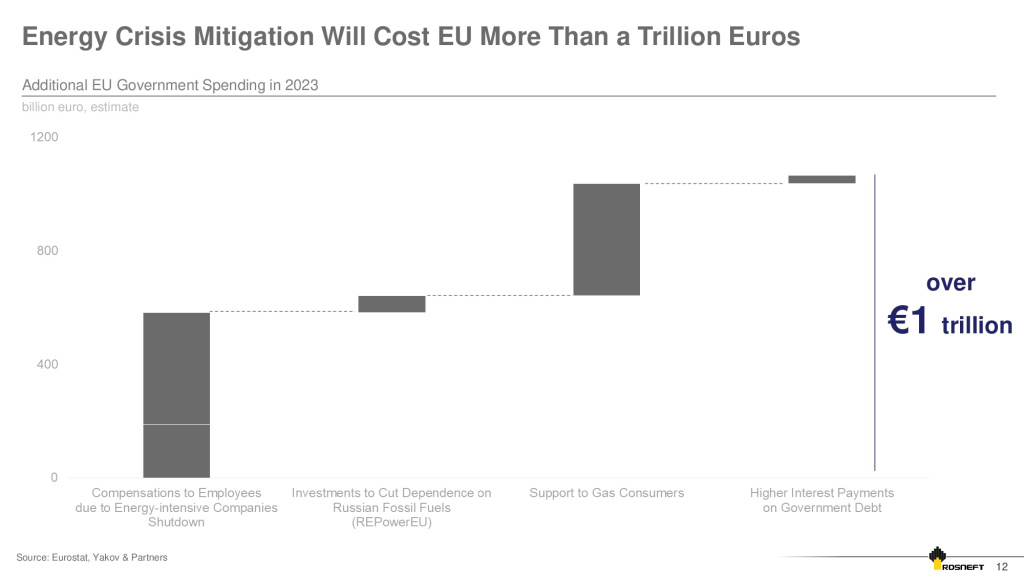

The cost to the EU of protecting consumers (businesses and households) from its own anti-Russian sanctions has exceeded €500 billion and will reach €1 trillion by the end of the year.

Europe, which lost its identity and opportunity to diversify its energy supplies has become the primary victim of U.S. policy was. And as a result, the outflow of capital and industrial enterprises, redirecting their activities to the United States, where conditions are more preferable.

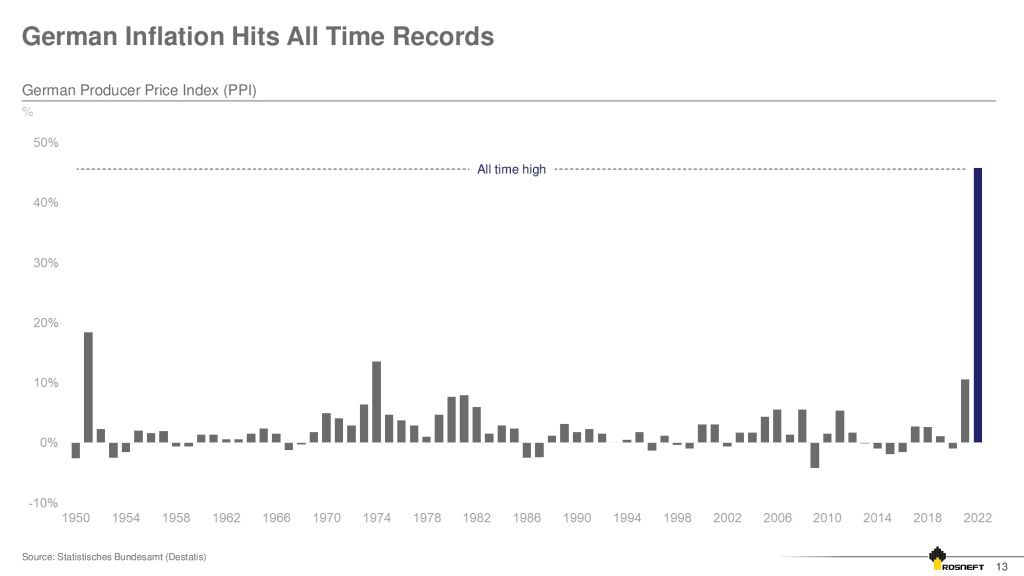

Consumer inflation in Germany and, incidentally, the Eurozone average is almost 11%. And here is the data on industrial inflation from German Federal Statistical Office. The producer price index is 45.8%. It is the all-time historical record since 1949. The problem is not that industrial inflation will lead with some lag to consumer inflation, but that with such industrial inflation, industry becomes uncompetitive. And that means jobs.

EU economy weakening and lower interest rates lead to an avalanche-like outflow of financial capital from European countries. The flight of capital from Europe to the U.S. has already been followed by a flight of manufacturing — the largest chemical corporations BASF, YARA, OCI, the steel giant ARCELOR MITTAL, French ARK holding, Tesla and — the final flourish — announcement by Volkswagen, the symbol of German industry, to move production to the U.S.

Finally, it is the European banks that are in pre-bankruptcy: Deutsche Bank, Credit Suisse. Credit Suisse has lost 95% of its shareholder value from its peak.

The key branches of European industry — metallurgy, chemical, pulp-and-paper and agricultural industry — are experiencing the crisis. The potential output reduction is estimated between 20-45% in the chemical industry and 30-60% in metallurgy. 70% of nitrogen fertilizer production facilities have already been shut down in Europe, aluminum production has been reduced by 25%.

Europe’s refusal of Russian energy supplies threatens 6.5 to 11.5% of European GDP and about 16 million jobs.

Russell Napier, a prominent market strategist and economic historian cites data on loans to corporations in the European Union since February 2020. Of all the new loans, government guarantees account for 40% in Germany, 70% in France, and over 100% (!?) in Italy, as old loans get transferred to new government-guaranteed schemes. This is the new norm.

Therefore, by telling the banks how and where to give guaranteed loans, the governments are directing investment where they want it. This is completely contrary to the economic system of the last 40 years, where the growth of credit and the broad money supply in the economy was controlled through the level of interest rates, which in their turn were controlled by the central banks. Today, central banks are becoming an appendage of governments — in Europe, England, Japan. The U.S. is still lagging behind and that is why the dollar is rising and investment money is flowing from Europe and Japan to America.

Private investments reduction confirms market relations destruction.

Anti-Russian sanctions: The unprecedented sanctions pressure on Russia is, as we have said, only a catalyst for the processes caused by the crisis of the changing economic era, but a very powerful catalyst.

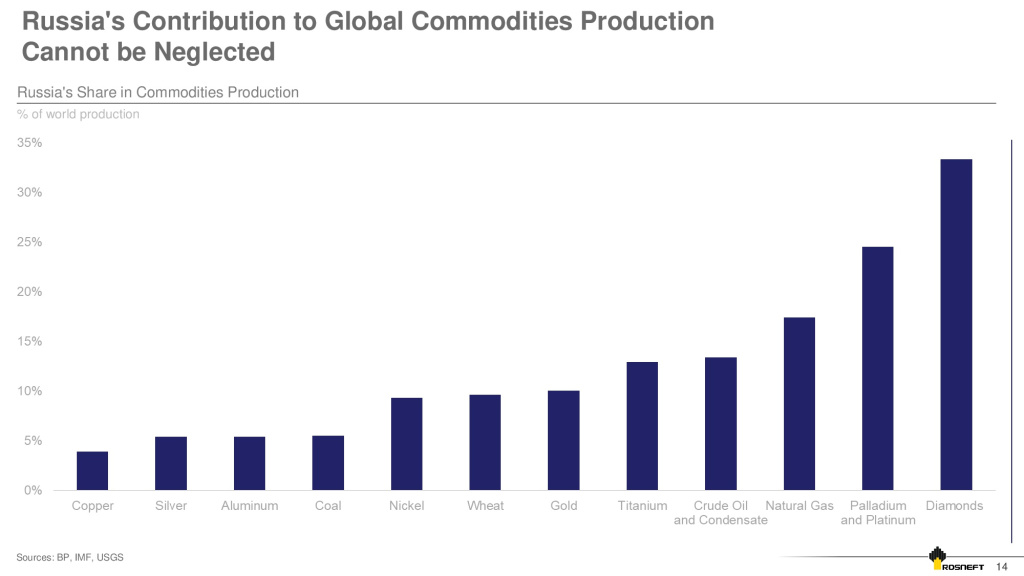

The idea of «cutting» Russia out of the global economy is absurd and illusory. The scale and role of the Russian economy in the global division of labor has traditionally been underestimated by the West. 2% of world GDP is a myth. If you count not at the exchange rate, but at PPP, it’s already 4-5%. If you consider the role of services in the developed economies — in the USA it is up to 70% of GDP... Services are a useful thing, but not when you have no energy or food resources. Russia’s share in the supply of basic raw materials is up to 15%.

Sustainability of the Russian economy is ensured by the fact that it stands firmly on the ground, relying on the sufficiency of basic resources.

«China has always offered cooperation as part of its development as new opportunities for the whole world. China stimulates the formation of an open world economy that benefits the people of all countries,» Xi Jinping said at the 20th Congress of the Communist Party of China.

China’s economy has been the main engine of global economic growth for decades. Over the past 20 years, China has made tremendous strides not only in economic growth, but also in the well-being of its population and the rapid conversion of its export-oriented economy to domestic demand. The growth of this demand is impressive. In Credit Suisse’s Global Prosperity Index China’s 2021 score of $6,752 surpasses the European average for the first time. In doing so, China ranks first in terms of wealth growth: an 8-fold increase from 2000 to 2021.

The 20th CPC Congress, which has already become historic, identified the main development priorities: strengthening national security, social sustainability and technological sovereignty.

All decisions of the Congress are distinguished by their strategic nature, deep thoughtfulness and integral approach. I am confident that their implementation will ensure a new level of China’s development in all areas.

The position of the PRC leadership, which calmly and openly, without false assumptions, sets out its vision, even on the most complex issues, such as the problem of Taiwan, causes great respect. It seems that the agitation around it is exaggerated as usual and provoked remotely! But I am sure it will calm down! Given the so-called «chip law» signed by President Biden on August 9, the point of which is to accelerate the creation of a full production cycle of complex logistics chips, which at the moment are almost entirely imported into the U.S. from Taiwan, on the territory of the USA. By 2027 it is planned to allocate up to $200 billion subsidies with tax credits and research incentives for the program implementation. Production establishment will cost $52.

Thus, it can be assumed that this program is a way to bring Taiwan back to its home harbor on schedule.

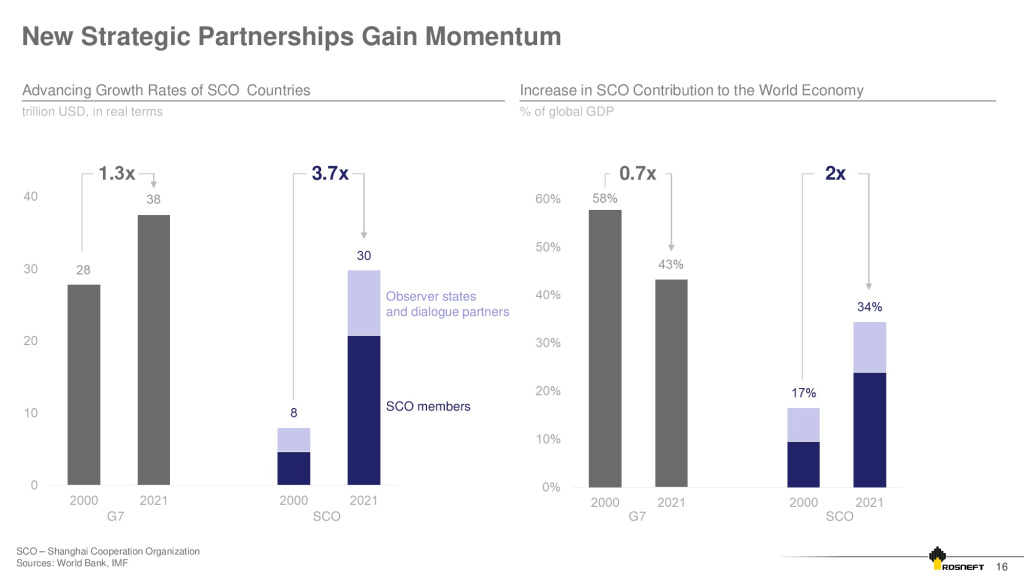

Investment deficits associated with green transition issues and secondary sanctions at the corporate level are contributing to the emphasis on regional ties strengthening. Increasing emphasis is being made on strengthening cooperation among growing markets.

Countries in Southeast and Central Asia, Latin America, and Africa are increasingly focused on strengthening ties, coordinating with Russia, China, and India.

What is important today is the fastest possible transition to financial cooperation without looking back at «unfriendly» financial centers for the process participants. The Priority is the organization of clearing settlements, which could be joined later by other interested countries (EAEC, SCO, BRICS).

We would like to see the Russian regulator be more active in this urgent issue as well.

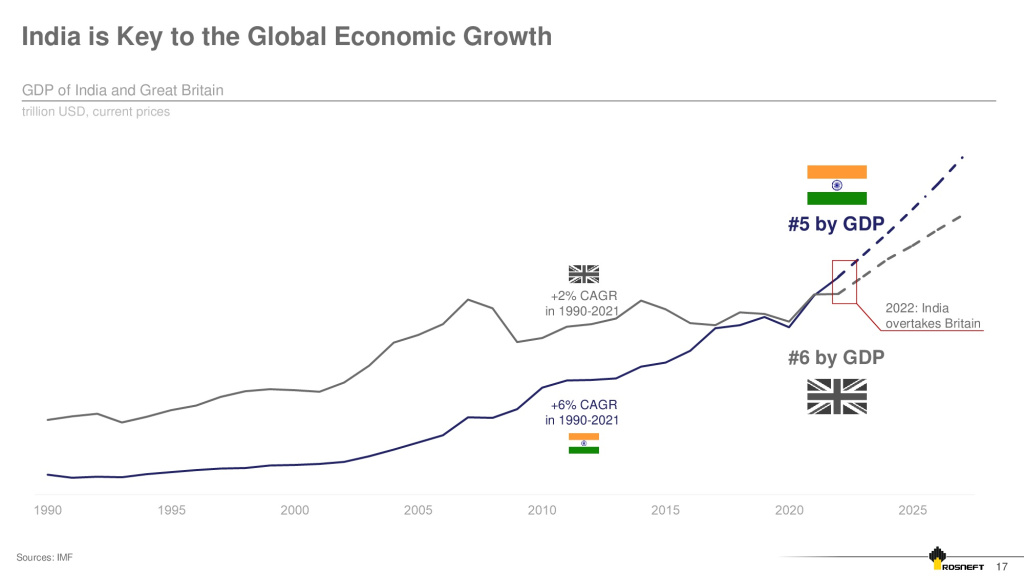

This year India became the 5th largest economy in terms of GDP and demonstrates the highest growth rate among major economies (6-8% on average in recent years).

Prime Minister Narendra Modi’s plan to make energy more accessible to everyone in the country has made India one of the key drivers of the global energy demand. India’s energy concept is not focused on one or two priorities, its objective is balanced development of all energy sources. As Narendra Modi figuratively put it, these are «the seven horses dragging the chariot of the Sun God,» the Indian energy sector and the economy as a whole. The inflow of foreign direct investment into India has increased from $4 billion in 2001 to $82 billion in 2021.

The increase in energy supplies, primarily oil and gas, has greatly increased Russia’s share in the structure of India’s imports. Russia’s share was 1.6% in 2021/22 fiscal year, and in April and May 2022 it reached 4%.

Rosneft values its cooperation with Indian oil and gas corporations, which actually develops along the entire technological chain. Rosneft is implementing three major production projects in Russia jointly with Indian companies: Vankorneft, Taas-Yuryakh Neftegazodobycha, and Sakhalin-1.

Rosneft is the largest Russian strategic investor in the Indian economy.

Having made the strategic decision to «turn to the East,» Russia has been steadily increasing energy supplies to the Asia-Pacific Region. With infrastructure development, Russian oil exports to China and India exceeded 80 million tons in 2021. Implementation of Vostok Oil project will allow us to meet any growing needs in the markets of Southeast Asia, India and China.

We seek a mutually beneficial partnership along the entire supply chain, from production to sales of fuel to end consumers. Vostok Oil will ensure long-term stability of the oil market and reduce price volatility by preventing energy resources price spikes which are not profitable to anyone.

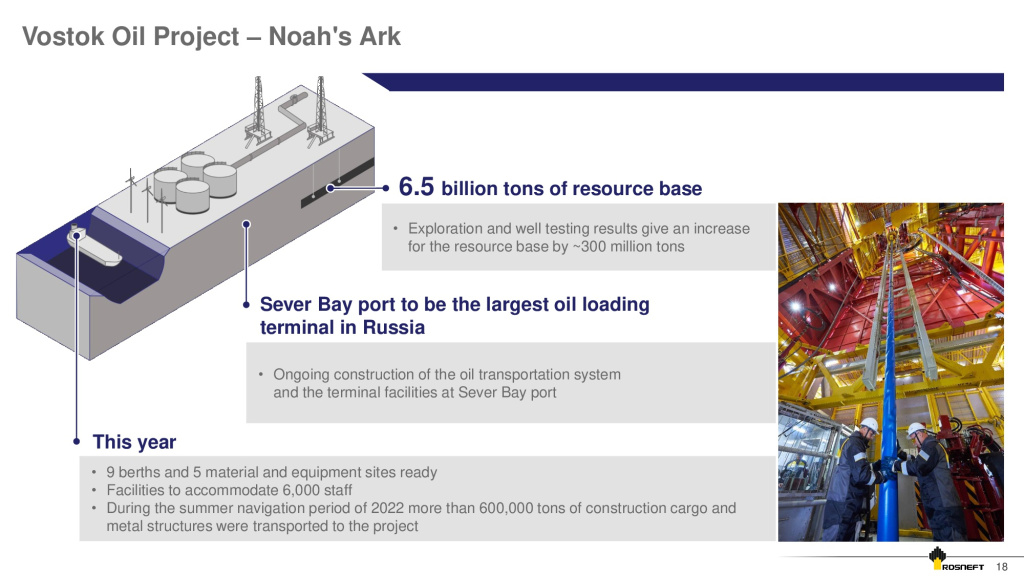

This year, a significant increase in oil reserves has been confirmed as a result of comprehensive exploration activities on the Vostok Oil project. The State Reserves Committee approved the discovery of two new deposits with recoverable oil reserves of 101.4 million tons on the left bank of the Yenisey River following the drilling operations in Zapadno-Irkinskoye field.

On the right bank of the Yenisey River, Peschanaya 1 Well of Payakha field tested, before reservoir fracturing, a natural flow of water-free oil in the depth interval of about 3,300 m at the reservoir pressure of 600 Atm. This significantly exceeds projected parameters and improves the efficiency of Payakha field development. Preparation is underway for performance of hydraulic fracturing and the drilling of development wells.

All of the above together with the results of 3D seismic survey in the Taimyr cluster suggests a significant, about 300 million tons, increase in the resource base of the project, from 6.2 to 6.5 billion tons.

The construction of the Project priority facilities continues on plan — the main oil transportation system — 25,000 piles have been installed and more than 100 km of pipes have been welded. Construction of a complex engineering facility — an underwater crossing under the Yenisey River — started. Expansion of the port’s onshore and wharf infrastructure and storage facilities continues, and so does the expansion of the terminal in the Sever Bay, which will become the largest oil loading terminal in Russia and will ensure the transshipment of over 100 million tons of oil per year from Vostok Oil’s fields via the Northern Sea Route.

More than 6.5 million cubic meters of soil have already been excavated; 9 berths and 5 materials and equipment storage facilities are ready for receiving and unloading; accommodation facilities for 5,000 personnel have been equipped; relocation camps for another 1,000 people are in the final stage. In the 2022-2023 season, up to 6,000 personnel and up to 2,000 units of equipment will be permanently employed.

During the 2022 summer navigation period, more than 600,000 tons of construction cargo and steel structures were transported, 285,000 tons of which were delivered via the NSR (more than 400 voyages were made).

The implementation of the project continues as per the previously announced schedule.

We will be glad to see our friends among the participants of this project.

I will conclude by quoting Iron Chancellor Otto von Bismarck.

We all understand that the «Abduction or in fact killing of Europa» is just an attempt to prolong the period of the American hegemony. However, the new historic cycle will inevitably come and will be associated with the development of cross-border corridors, major infrastructure and industrial projects, increase of the regions` role in the global economy and on the territory of our continent.

I would like to thank the forum participants and wish them fruitful work.