The McKinsey Global Institute report analyzes the main ways to achieve global carbon neutrality by 2050 in terms of financial, managerial, macroeconomic, technological, and other aspects of the net-zero transition.

Analysts of the Roscongress Foundation have identified the main theses of this study, accompanying each of them with a relevant piece of video broadcasts of panel discussions held as part of the business programs of key events held by the Foundation.

The net-zero transition will require vast resources from the entire global community.

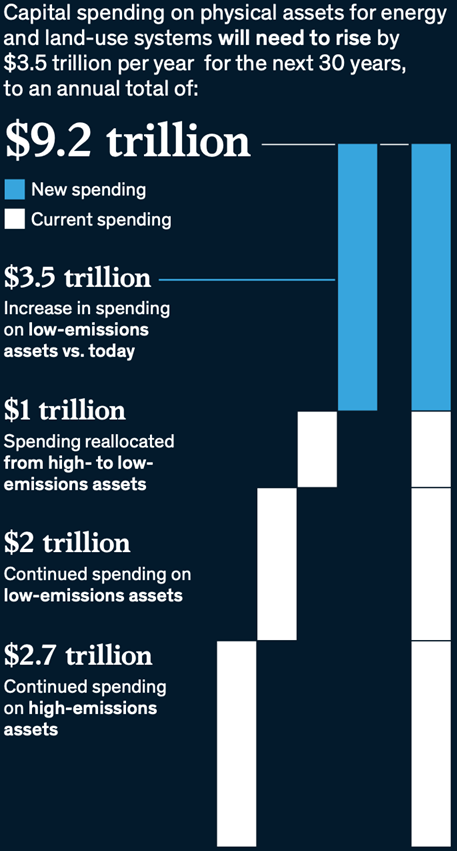

Capital spending on physical assets for energy and land-use systems in the net-zero transition between 2021 and 2050 would amount to about $275 trillion, or $9.2 trillion per year on average, an annual increase of as much as $3.5 trillion from today.

But gross investment, by itself, will not solve all the problems. More than 180 million jobs will be lost during the net-zero transition, significant changes will occur in industries that generate a fifth of global GDP at the moment, significant fluctuations will be inevitable in all energy markets, including the cost of final consumption of energy by households.

Video: roscongress.org/sessions/spief-2021-budushchee-energetiki-energoperekhod/search/#00:09:39.815

Russia is in the group of countries with the highest risks of global energy transition.

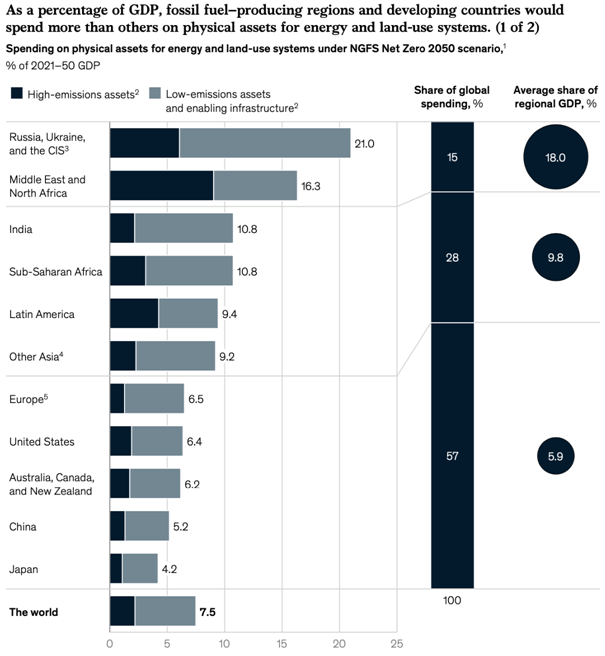

The consequences of the net-zero transition will be felt in all corners of our planet but in a rather differentiated way. The report notes that the net-zero transition poses the greatest challenge for countries with a high share in the economy of high-emissions industries, with outdated and worn-out infrastructure, with limited access to investment resources, with ecosystems most susceptible to climate change. Russia, to one degree or another, fits all these parameters.

Video: roscongress.org/sessions/zelenyy-rost-i-ekonomika-izmeneniya-klimata/search/#00:20:55.935

Risks and costs can be even higher with uncoordinated and unsynchronized efforts.

The economic and social costs of a delayed or abrupt transition would raise the risk of asset stranding, worker dislocations, and a backlash that delays the transition. Even under a relatively gradual transition, if the ramp- down of high-emissions activities is not carefully managed in parallel with the ramp-up of low-emissions ones, supply may not be able to scale up sufficiently, making shortages and price increases or volatility a feature. Much therefore depends on how the transition is managed.

Governments and multilateral institutions could use existing and new policy, regulatory, and fiscal tools to establish incentives, support vulnerable stakeholders, and foster collective action. The pace and scale of the transition mean that many of todays institutions would need to be revamped and new ones created to disseminate best practices, establish standards and tracking mechanisms, drive capital deployment at scale, manage uneven impacts, and support further coordination of efforts.

Video: roscongress.org/sessions/spief-2021-budushchee-energetiki-energoperekhod/search/#00:16:10.815

We also invite you to familiarize yourself with other materials posted in special sections of the Roscongress Information and Analytical System Climate change, Investment management, Renewable energy sources and «Green» technologies, dedicated to possible responses to the global climate challenge.