The World Bank report describes the current macroeconomic trends in Russia and their relationship with the COVID-19 pandemic and the global climate agenda.

Analysts of the Roscongress Foundation have identified the main theses of this study, accompanying each of them with a relevant piece of video broadcasts of panel discussions held as part of the business programs of key events held by the Foundation.

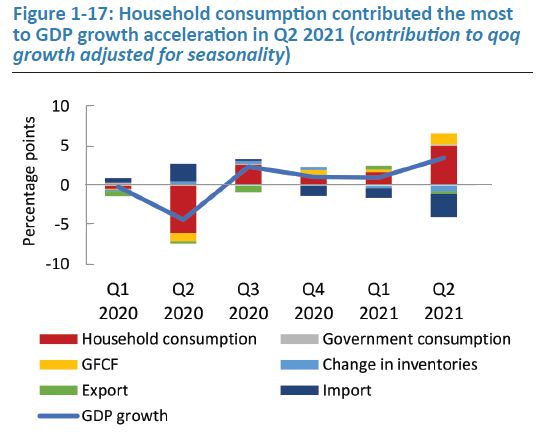

Household consumption has become the basis of post-COVID economic growth in Russia.

In the 2Q of 2021, the Russian economy showed the best value of GDP dynamics since the beginning of the pandemic. The main drivers of growth were household consumption and gross fixed capital formation, which grew by more than 9% and 6%, respectively, compared to the previous quarter.

Such data are primarily associated with a reduction in the volume of internal epidemiological restrictions against the background of the absence of mass outbound tourism. The leaders in investment growth are the wholesale and retail trade, finance and ICT industries.

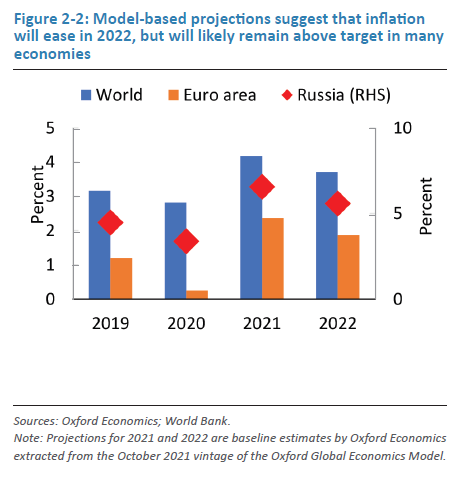

Russias GDP growth in the coming years will be below the world average and will not exceed 2.5% per year.

As countries move into the third year of the COVID-19 pandemic, global growth is expected to moderate down next year to 4.3 percent. Inflation is expected to ease somewhat into 2022, but inflation rates are still likely exceed their levels in 2019. Oil prices are forecast to remain high, averaging US$74/bbl in 2022 and US$65/bbl in 2023, respectively, while natural gas and coal prices are forecast to fall from their presently elevated levels. Growth in Russia is forecast to be 2.4 percent next year, contributed to by a continued strong oil sector, before moving down to 1.8 percent in 2023. On-off COVID-19 control measures, likely to be needed while vaccination rates remain low, will weigh on growth and may call for more accommodative policy, especially fiscal, frameworks to support those affected. With the Central Bank of Russia maintaining an appropriately tight monetary stance, inflation is expected to decline in 2022. Inflation has negatively surprised in Russia and around the world this year, and uncertainty over the persistence of inflation effects remains high. Combined with the Federal Reserves planned unwinding of quantitative easing in the United States, and other monetary tightening likely in advanced economies, higher than expected inflation and capital outflows, which may call for further monetary tightening, represent a risk to the outlook.

One of the main risks in the Russian economy in the short term, according to the World Bank, is vaccine hesitancy.

Russias vaccination program, although ongoing for some time, has only vaccinated a third of the population and progress has slowed up to late October. Russia has developed four candidate vaccines for COVID-19, of which two Gamalea Sputnik V and Gamalea Sputnik Lite have undergone Stage 1, 2 and 3 trials. Sputnik V was in fact the first vaccine to be announced to be developed to combat COVID-19, beginning clinical trials in June 2020. While neither is yet approved by the World Health Organization, Sputnik V has been approved for use in 73 countries and Sputnik Light in 19 countries. The other two candidate vaccines are largely only in use in Russia. Developed and with ample production facilities locally, there are no major supply issues that constrain vaccination deployment. At present, only these locally developed vaccines are approved for use in Russia, while the AstraZeneca vaccine is under trial.

Low vaccination rates in Russia are linked to vaccine hesitancy. International surveys show Russians are amongst the least willing to receive a COVID-19 vaccine, with more than 50 percent of survey respondents indicating that they would not get a vaccine if it were offered to them. This reluctance seems to be relatively equally distributed amongst age groups, and even amongst those respondents that state that they are afraid of contracting COVID-19, still nearly half of those not yet vaccinated said they would not take a vaccination. The most common reason cited for not receiving the vaccination was a concern with side effects, with as many as 80 percent of the overall population being concerned about side effects.

We also invite you to familiarize yourself with other materials posted in special sections of the Roscongress Information and Analytical System Economic progress, COVID-19, Monetary policy, Climate change, dedicated to economic development in the context of the COVID-19 pandemic and the global net zero transition.