National Rating Agency (NRA) experts present an analytical review of the repayment holiday impact, which is part of a set of measures to overcome the negative economic consequences of the crisis caused by the coronavirus pandemic. The review examines various aspects of the repayment holiday influence on the Russian banking system, provides data on the total value of the loan portfolio affected by credit holidays, as well as estimates banks profit losses in various segments.

Roscongress Foundation analysts highlighted the main theses of this research, accompanying each of them with suitable fragments of video broadcasts of panel discussions held as part of business programs of the key events hosted by the Foundation.

The main feature of the crisis caused by the coronavirus pandemic is a significant drop in economic activity in the service sector. In this regard, about 20% of the SMEs loan portfolio will be affected by credit holidays.

Based on the small businesses predominant employment in the service sector, the crisis of 2020 will be characterized by a significant drop in economic activity in this segment. The baseline forecast of NRA experts is that about 20% of the SMEs loan portfolio will be affected by repayment holiday. According to the Bank of Russia (Central Bank of the Russian Federation), from 20 March to 1 April 2020, ten largest banks have already received 16 thousand applications from SMEs, 95% of them were satisfied by banks.

The provision of holidays will not affect the banks profits, as interest will continue to accrue but not be paid. Nevertheless, the volume of liquidity not received by banks due to credit holidays in the SMEs segment will be, as estimated by NRA (with an average loan offer rate of 9.3% according to the Bank of Russia) about RUB 38-47 billion.

NRA experts assume that possible liquidity problems will affect a small number of banks. This is due to the high concentration of SMEs lending in large banks, which consists the top 30 banks in the Russian banking system (72%). The banks in the top 30 currently have a stable position in liquidity and good access to liquidity sources, therefore, a small number of banks outside the top 30 will need possible assistance from the Central Bank to provide liquidity.

Out of 27 thousand applications for restructuring loans provided to individuals, 17% were satisfied due to the non-compliance of many applications with the criteria for credit holidays and the revealed instances of fraud.

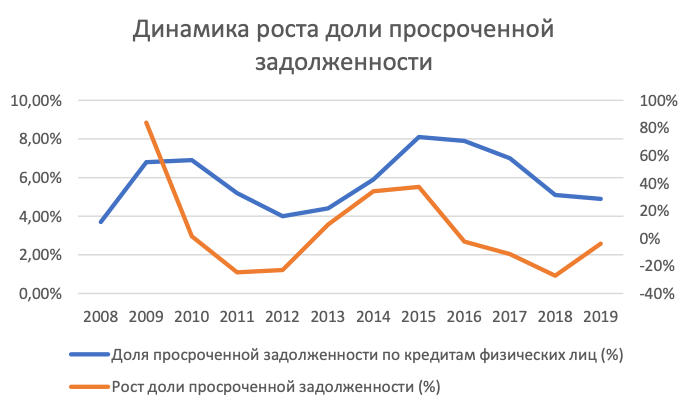

The share of the loans portfolio extended to individuals who are on credit holiday will be primarily determined by the maximum loan size limits set by the Russian Government.

According to the Central Bank of the Russian Federation, from 20 March to 1 April 2020, ten largest banks have already received 27 thousand applications for loan restructuring due to a decrease in income. 17% out of 12,500 applications reviewed (9,800 for unsecured consumer loans and 2,700 for mortgages), were satisfied. The low satisfaction rate is explained by non-compliance with the repayment holiday criteria and revealed instances of fraud.

Based on these dynamics, the share of loan portfolios of unsecured loans and mortgages subject to repayment holiday will amount to RUB 1.4 trillion and RUB 385 billion respectively. According to NRA estimates, the amount of liquidity that banks have not received due to repayment holiday in the segments of lending to individuals will amount to about RUB 100 billion (assuming an average loan rate in the unsecured lending sector of 12% and an average rate in the mortgage loan sector of 9%).

Interest on loans that are in credit holidays will be charged at a preferential rate 2/3 of the average rate for a similar type of consumer loan. In addition, the holiday provision will increase banks operating costs for supporting these processes and technological changes, including in information systems, especially given the extremely tight deadlines for introducing this innovation for loans other than mortgages. According to NRA estimates, banks profit losses from these restrictions will fluctuate between RUB 40-50 billion.

As in the case of loans to SMEs, possible assistance from the Central Bank to provide liquidity may be required only for banks that are not in the top 30.

Video: https://roscongress.org/sessions/tekhnologii-zhilya/search/#00:32:59.967

We also offer you to get acquainted with other materials, posted in StayHomeEconomy, Monetary Policy, Financial Market special sections of the Roskongress Information and Analytical System, on possible ways to stabilize the economy in a pandemic, as well as issues related to the budget and macroeconomic indicators.