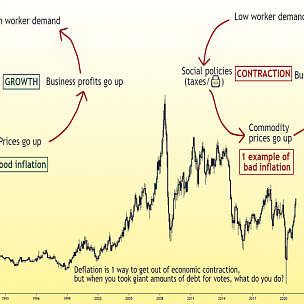

As an introduction, the authors of the report observe that in the last decade Eurasian Economic Union (EAEU) foreign trade performance has fluctuated. Trade increased annually at a moderate rate between 2007 and 2012, then reached its lowest level in 2016, but began to recover in 2017 when total trade volume climbed back up to approximately USD 741 bil., a 25% increase over 2016. The Intesa Sanpaolo experts name dynamics of energy prices and of the economies of the major trading partners, on the one hand, and the evolution of the cycle in the Eurasian region, on the other hand, as the main factors affecting EAEU import and export performance in the period. These were joined in 2014 by the effects of the progressive sanctions and counter-sanctions between Russia and Western countries. The inward stock of foreign direct investments (FDIs) in the Eurasian Economic Union countries has also fluctuated, reaching USD 31.5 bil. in 2017.

.png)

Besides the general changes in trade dynamics, EAEU countries have experienced significant changes in terms of sectors and geographical breakdown. While the share of EU countries in EAEU turnover has dropped, Chinas portion has noticeably increased and continues to grow. Generally, the Intesa Sanpaolo experts highlight the reorientation of EAEU external trade policy towards China as the main trend. At sectoral level, there were changes as well: for example, with regard to Russian trade (which, on its own, covers approximately 80% of EAEU country trading globally), total machinery purchased in EU countries dropped from 42% in 2012 to just over 33% in 2017. The portion of Russian fuel covered by the EU dropped to less than 45% in 2017, compared to almost 54% in 2012. In this context, as the authors of the report note, the direct impact of the USAs tariffs on steel and aluminum on the regions exports as a whole is limited. However, potentially significant repercussions are expected at sectoral level.

Besides the economic aspect, the geopolitical relationships between the major players take on particular significance in terms of possible future outcomes in a global scenario in transition. The geopolitical activities of the EAEU move in two directions. The first is devoted to the process of economic integration among member countries, with the aim of establishing an area of free exchange of goods, services and capital, and freedom of movement of persons; the second is addressed to cooperation with external partners, in particular with the countries of Europe (primarily the EU) and Asia (China and Central Asian countries but also the Middle East and South-East Asia), through trade agreements, infrastructure projects and improvements in security.

Insofar as the trade and investment relations of Italy with EAEU countries, trade volumes began to climb again in 2017, reaching EUR 23 bil. The recovery in energy prices and the positive economic situation in Italy and EAEU countries were the main drivers of growth. Currently, Italian imports mainly consist of mineral products, especially energy and refined petroleum products, followed by metals. Exports consist of machinery, followed by textiles, chemical products, metals, and transport equipment.

.png)