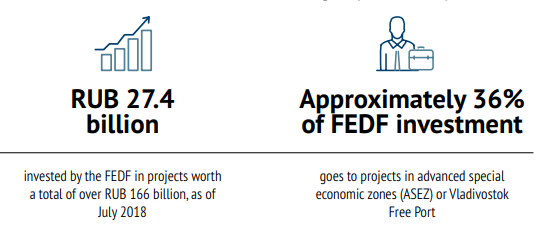

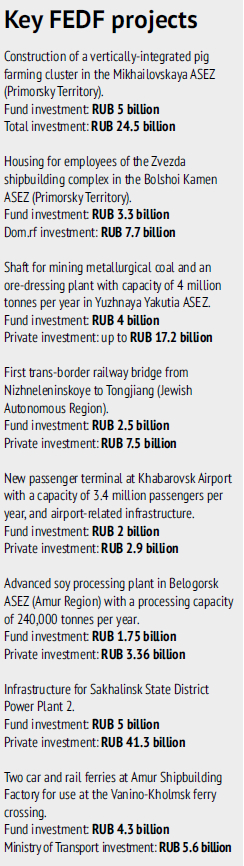

The Far East Development Fund (FEDF) is a key newsmaker when it comes to the regional economic agenda. The Funds investments include major infrastructure projects and programmes to support small and medium-sized enterprises, agriculture, and high-tech solutions. FEDF CEO Alexey Chekunkov discusses four areas of potential in the Russian Far East, the preferences of Asian consumers, and the magic of the speculative market.

«We need entrepreneurial wizards»

What trump cards do you hold in negotiations? How do you hook investors?

There is a law of physics which states that the most massive bodies exert the strongest gravitational pull. From an economic point of view, the most massive bodies are in Asia: China, Japan, and Korea. In contrast, the Russian Far East is not an economically massive body, even though it is physically enormous. Herein lies the opportunity. Everything that helps to connect the Russian Far East with the Asia-Pacific regional economy has huge potential.

This means mainly the commodities that Russia trades with Asia: hydrocarbons, precious metals, coal, lumber, and organic resources...

Then there is potential in logistics. Take the Belt and Road Initiative, for example. Currently, 90% of Chinese exports essentially pass through the Strait of Malacca, which is controlled by an American military base. There is total dependence on a single route. So Chinas goal is to create a wide overland channel via which it can move goods to Europe. This will require the construction of a huge number of roads and railways, and an energy infrastructure.

The third vital aspect is what I call «food and water». Over two billion people live in Asia, not counting India. Rapid economic growth in China has disturbed the food balance. The soil has been aggressively cultivated, and industry has grown without regard for environmental issues. As a result, in a nation of 1.5 billion people, theres not enough land to till. The Russian Far East has millions of hectares perfect for crop farming. In the south, along the Chinese border, wheat, soy, and an amazing coastal rice variety grow wonderfully. We simply need to support exports properly, and develop integrated projects, in which, for example, some production will be located in Asia, with processing in Russia. Why is it profitable to export drinking water to China or Korea from France, but not from the Russian Far East? The Primorsky Territory is closer.Finally, but very importantly, there is the economy of lasting impressions, tourism. These places are beautiful and European in spirit. Theres nowhere else like them in Asia. Ive seen the reactions of my Asian colleagues, people who have seen a great deal, when they first lay eyes on Russky Island in Vladivostok. And so few of them have been to Kamchatka yet! Tourism is also a market worth billions.

Given all that, what are we lacking when it comes to realizing this potential: investment or properly designed projects?

Imagine that you and I are talking about interesting literature. What are we lacking there? Paper, letters, or writers? Money is the paper. It can always be found for a worthy endeavour. The Chinese banking system has double the assets of the US banking system and something like 25 times the assets of the Russian system. Trillion-dollar figures are no longer surprising for many projects in Asia.

The projects are the letters. Specific people dream them up. So the most important precondition, the catalyst, is the entrepreneurship factor. We need wizards who can conjure up a real-life business from an abstract theory, something that requires enormous amounts of effort and commitment.

At the national level, we need to concentrate efforts on supporting talented entrepreneurs and developing management technologies. Our eastern partners serve as good examples for us here. China was once called the worlds factory. People thought that clever Americans invented Apple phones in California, and the Chinese just assembled them in their cramped dormitories for paltry salaries. But thats not the case. Now we have Xiaomi, HTC, and Lenovo. Or look at the Koreans. Who would deny, today, that Samsung is a world-class company? And what about Korean car manufacturers? Over the past 20 years, these countries have managed to create world-class consumer brands. Russia can do the same.

Which sectors might see breakthroughs?

Agriculture, for one. Here, companies can increase their capitalization by a factor of ten. Rusagro is currently building a major pig farming complex in the Far East. For now, it is counting on domestic demand. Six million people can eat 77,000 tonnes of pork, but the market is fairly saturated. However, as soon as the eastern markets open up, they will be in place with production capacity at the ready. Or Amuragrotsentr, the leading soy producing enterprise.

Asia is very selective when it comes to imports. They see themselves as producers of goods for the world, but consumers of their own, tasty domestic products. Japanese rice is eight times more expensive than global brands, but that is what they choose. Every American CEO has dreamed of conquering Asia. In the 1970s, they liked to say that if every Chinese person drank one can of Coca-Cola, theyd be USD 1.5 billion richer. But that never happened.

Why do you think well succeed in teaching the Chinese to drink Russian Coca-Cola?

There is an unprecedented trade war underway in the world. We do not know where it will lead. Many companies may close up shop, unable to pay back their loans, and some banks may collapse. Under these conditions, it is unwise for neighbouring countries to keep their markets closed to one another. This is an opportunity for us. We must take advantage of it as a country, particularly at the Eastern Economic Forum. We must strengthen Russias position and expand our exports. It is interesting, complicated work. Our president always discusses open markets when he meets the leaders of China, Japan, and Korea. Its a vital part of any negotiation.

«Our strategy is to support powerhouse projects»

Under what conditions does the FEDF get involved in a project?

We are a development institute. Our strategy is to support powerhouse projects. If one of those turns out to be successful, dozens more will follow. At the same time, the FEDF has a fundamental obligation not to lose money.

In 2011, after the financial crisis, there was unfettered growth in investment. When I took over as FEDF director in 2014, Vladimir Putin made a memorable statement in an address to the Council of the Federation: «Many development institutes have become a dumping ground for bad debts.» This is not a problem afflicting only Russia, actually. There are plenty of examples around the world in which the road to hell has been paved with good intentions. Private businesses do not take on problematic projects. Government officials are left to solve those problems using government funds and end up getting into trouble.

In 2011, after the financial crisis, there was unfettered growth in investment. When I took over as FEDF director in 2014, Vladimir Putin made a memorable statement in an address to the Council of the Federation: «Many development institutes have become a dumping ground for bad debts.» This is not a problem afflicting only Russia, actually. There are plenty of examples around the world in which the road to hell has been paved with good intentions. Private businesses do not take on problematic projects. Government officials are left to solve those problems using government funds and end up getting into trouble.

We are a conservative investor. We need strong partners. We hand out money for an extended term at a 5% annual interest rate, which is on average half as expensive as the banks. But if something goes wrong, we must have an understanding about how we will get our money back. Even if an asteroid lands on a project, our portfolio remains balanced, and the Fund can return every invested rouble to the government with a return, even if only a small one.

How much money should every rouble you invest earn for the economy?

There are three parameters: how much they generate in taxes, how much for the GRP, and how many productive jobs are created. There is no one single metric. A high-tech project might only create ten jobs, but those will all be brilliant programmers who will change the world. A thousand jobs at an oil refinery bring in several billion dollars to the GRP.

A development institute is not supposed to strive for maximum profits. Our goal is for every invested rouble to expand the volume of the new economy. Here is one example. A couple of years ago, Yury Trutnev and I met in Vietnam with the owner of TH Group, the countrys biggest producer of dairy products. As a result of that meeting, she invested RUB 1 billion in the Russian Far East to develop dairy farming. It is absolutely a world-class company. Businesses like these bring better diversity and higher quality to the economic business landscape of the Far East.

In spring 2018, a Russian Japanese investment platform was launched. Could you explain the need for that project? And are there plans to create similar platforms with other Asian partners?

We dont have plans with other countries. This is a thoroughly Japanese story, but it is extremely important for them. Prime Minister Shinzō Abe is always emphasizing that point in meetings. The platform enjoys the comprehensive support of the Japan Bank for International Cooperation (JBIC). Essentially, it is a consulting company with a very narrow mandate focused on advising Japanese companies about how they can develop projects in the Russian Far East. Every Japanese company understands that it offers a single window to help resolve all sorts of issues, that can raise their concerns at any level necessary, up to and including the Presidential Plenipotentiary Envoy to the Far Eastern Federal District. The Japanese themselves wrote the platforms business plan, and it is very ambitious: financing 35 projects with RUB 83 billion of smart investment over five years. Right now the platform is running ten projects. I personally believe in this model, because it has already proven successful in other countries: India and Myanmar.

«Id like Russian entrepreneurs to have the ability to sell their dreams»

How are you addressing recapitalization of the Fund?

Naturally, we dont have enough money for the full slate of projects we are considering. The Prime Minister has taken the decision to add RUB 11 billion to the Fund. Normally, the FEDF can invest around RUB 20 billion per year, and we will continue to work at that pace.

The Fund for the Development and Commercialization of Advanced Technology which you recently launched with Rusnano and RVC is that an attempt at venture financing?

The President has issued instructions to increase the share of high-tech businesses in the Far Eastern economy. There is already a framework there for us to flesh out. Aircraft assembly for the Sukhoi Superjet, the Vostochny Cosmodrome, United Shipbuilding Corporation, modern lumber industry technologies... But how have we approached this task? Dictating the creation of a venture fund is risky. So we called our project the Fund for the Development and Commercialization of Advanced Technology. The word commercialization is very important here. Up to 90% of the fund will go towards commercializing existing products that have a client base and have proven their ability to perform. This includes promoting them in foreign markets, drawing on Rusnanos experience and cooperation with Asian partners. But there will be a small amount of seed funding as well.

Youve spoken about the possibility of creating a crypto valley in Vladivostok. What is the background for that project?

The authorities in different countries have different attitudes towards blockchain technologies. Meanwhile, the business world has already created projects worth hundreds of billions of dollars in the sector, and entrepreneurs are searching for the most accommodating jurisdictions. I believe that our proximity to Asian markets and Vladivostoks special status gives it quite high potential as a platform for blockchain development. We have surveyed market interest, and it is very high. But for now, government agencies are taking a conservative approach.

A good investor provides not just money, but also know-how and connections. How does the FEDF make itself useful to business?

We are an ideal local partner, forging contacts on the ground and accelerating project implementation, while significantly reducing risks. We spend a great deal of time in the Russian regions, so we know this area well, right down to the mobile phone numbers of every deputy mayor and director of a regional enterprise. Its also vitally important that we do not merely advise, but also invest our own money. We are motivated to fight tooth and nail for these projects. All sorts of difficulties can arise. To draw an analogy with the recent World Cup, even the most gifted footballer cannot score a goal on his own. A good passing game is essential. Development institutes help the state make a pinpoint pass to business.

The 2018 World Cup is over. The Eastern Economic Forum lies ahead. What are your expectations for the event?

Every year, the Forum seems to achieve perfection, and yet each subsequent Forum is better than the one before. I think that China will play a big role at EEF 2018. We have been working for a long time to create a Generational Fund with our Chinese partners for investment within the Belt and Road Initiative. This fund will be different from many similar platforms that have been announced in that it was created from the outset by private investors: two major entrepreneurs investing a billion dollars each. Only later was it joined by traditional, big companies such as China Gold, China Construction, and others. We hope that the first deals that will bring large-scale Chinese investment to the Russian Far East will be announced at EEF. They can be measured in the tens of billions of dollars, so the FEDF is acting more as a content supplier than as an investor in these projects. That is, we attract the billions by investing our own experience and knowledge. That is exactly the development impact we are striving to achieve.Text: Dmitry KRYUKOV

Source: EEF 2018 Official Magazine