A joint study by Data Insight and Avito is devoted to the main trends in the development of the C2C online trade market in Russia in 2017-2022.

Analysts of the Roscongress Foundation have identified the main theses of this study, accompanying each of them with a relevant piece of video broadcasts of panel discussions held as part of the business programs of key events held by the Foundation.

The C2C online trade market in Russia is developing dynamically both quantitatively and qualitatively.

Over the four years from 2017 to 2021, the volume of the C2C online trading market in Russia grew by almost 4.5 times to 1.32 trillion rubles. The number of transactions over the same period increased by 5.7 times and amounted to 514 million in 2021. At the same time, the share of sales of used items is decreasing and the number of sales of new/handmade goods is growing. If in 2017 only every tenth transaction fell into this category, then in April 2022 it was already every fifth.

More and more sellers sell goods outside their locality. In 2017, almost three-quarters of transactions were carried out within the locality, and in 2021, more than half of the sales were outside the sellers locality. As a result, sellers have become more likely to use «professional» delivery by courier and to points of issue. Delivery to the pickup point in 2021 was equal in share to the Russian post and increased by 6% compared to the previous year.

C2C online trading is gradually transforming from a way to get rid of old things into a business model.

In 2017, over 40% of salespeople did not view their sales as income. 5 years later, in 2022, already 89% of sellers consider their sales on C2C online trading platforms as one of their sources of income.

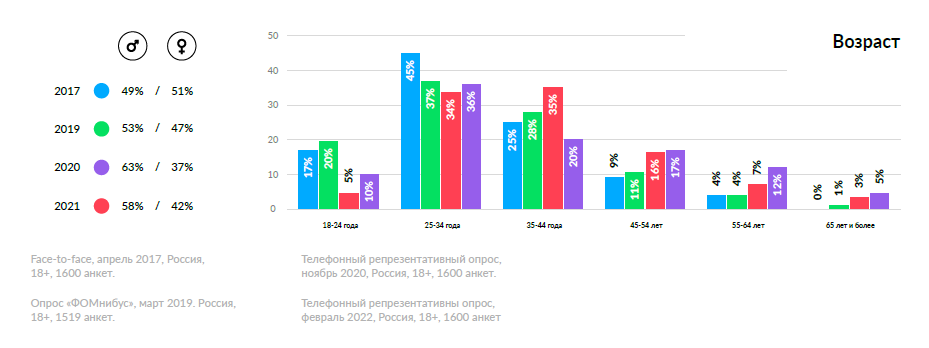

The most significant growth in the popularity of C2C online trading occurs in cities with a population of 100 to 500 thousand people. At the same time, the portrait of the average seller is changing. If in 2017 it was a woman from 25 to 34 years old, then starting from 2019 the share of men has consistently exceeded the share of women and the share of sellers over 45 years old is growing (from 13% in 2017 to 34% in 2021).

The main platforms for C2C online trading are traditionally ad sites.

The share of transactions made on ad sites during all the years of the study is between 80% and 90%. In 2021, 21% of C2C merchants used Facebook* and Instagram* (* - Belongs to the company Meta, banned in the territory of the Russian Federation). After these services left the Russian market, 14% continued to use them, while the rest were redistributed between Avito, Yula and Vkontakte. By June 2022, the use of Avito by private sellers increased by 10%, Yula by 6%, Vkontakte by 8%.

We also invite you to familiarize yourself with other materials posted in special sections of the Roscongress Information and Analytical System E-commerce, Consumer Sentiment and Entrepreneurship devoted to development of online trade.