The study by the Analytical Credit Rating Agency (ACRA) is focused on main sources for Russian macroeconomic forecasts, such as official public sources, international organizations and development institutions, credit rating agencies, and consensus surveys. Based on data from these sources, ACRA conducted an analysis of systemic biases and predictability of indicators by calculating deviations of forecasted values from factual values and from the consensus (an average or median forecast produced by combining various forecasts).

The Roscongress Foundation presents the salient points of the publication accompanied by fragments of broadcasts of relevant panel discussions from the business programme of international events held by the Roscongress Foundation.

Historical accuracy of a macro forecasts source determines the degree of confidence in it.

There is a wide range of regularly updated public macroeconomic forecasts for Russia so users of forecasts can choose a forecast source that best answers their needs. Most forecasts contain inflation data and at least one economic activity indicator; other than that, the set of indicators is different. The forecast horizon does not usually exceed five years. The majority of forecasts are updated semiannually or more often and contain annual data. Stress scenarios and other scenarios that differ to the baseline ones are rarely published. The quality of a macro forecasts source can be determined by looking at the history of previous forecasts.

Video: https://roscongress.org/sessions/novaya-model-ekonomicheskogo-razvitiya-v-mire/search/#01:11:15.130

Nearly a half of consensus survey participants demonstrate a systematic bias relative to the consensus (relative bias).

Most sources of forecasts for a particular indicator do not demonstrate consistently positive or negative deviations from the fact; however, they are often persistently «pessimistic» or «optimistic» in comparison with other forecasters. Their expectations have a systematic bias relative to the consensus, which in some cases correlates with the industry affiliation of the author of the forecast. Therefore, economic growth forecasts for the year ahead produced by investment companies, on average, almost always turn out to be more optimistic than the consensus forecast.

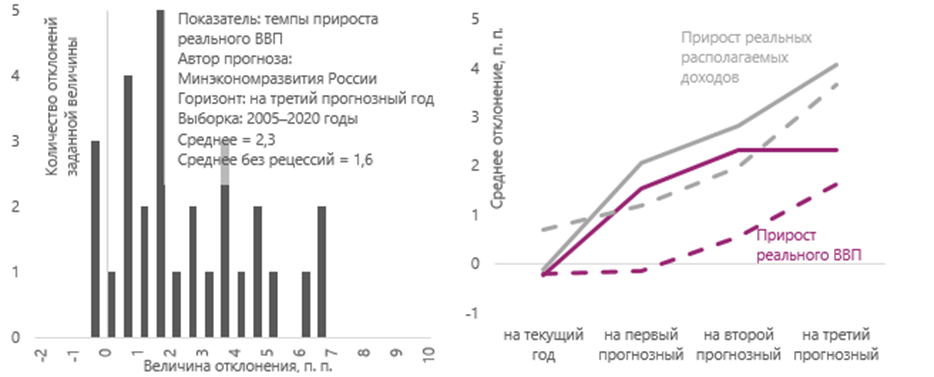

Bias of expectations relative to the fact (absolute bias) is more typical of official sources.

The forecasts of the growth of real GDP and household income published by the Ministry of Economic Development of Russia (MED) can be seen as typical examples of this sort of bias as they are historically overestimated over a forecast horizon of more than two years. This may be largely related to the fact that these indicators are targets for the Ministry, and therefore, assumptions about the effectiveness of stimulus or structural measures cannot be too conservative and should imply a certain improvement in dynamics. Other analysts forecasts for similar horizons are usually not biased or biased to a lesser extent.

The average deviation of the forecast from the fact depends to a greater extent on a specific indicator than on the selected forecast source.

Macroeconomic indicators are characterized by differing volatilities, which, as a rule, determines the level of their predictability: the distribution of forecast biases for each indicator depends more on the indicator itself than on the forecast source. This is confirmed, for example, by the closeness of the mean and maximum deviation moduli for different public forecasters. Adjusting the baseline scenario for the maximum historical deviation of the forecast from the fact is one of the simple ways to build macroeconomic stress scenarios.

Video: https://roscongress.org/sessions/sleduyushchie-20-let/search/#02:36:40.820

For more information about possible ways to stabilize the economy during the pandemic and about various aspects of monetary policy and financial market development opportunities, see the Monetary policy, Financial market, and Economic progress sections of the Roscongress Information and Analytical System.