With oil supply growing, there is less potential supply available

Strategy& experts believe that the oil and gas industry now feels much healthier than it did 12 months ago: The price of oil has rebounded. After appearing limited to a range between the mid-$40s and $50 per barrel (bbl), Brent crude is now trading above $70. The industry is thus recovering from the brutal last few years of weak prices, enforced capital discipline, portfolio realignments, and productivity efficiencies.

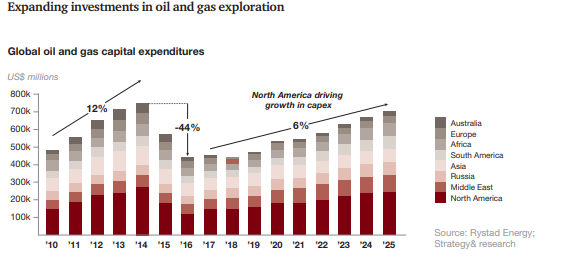

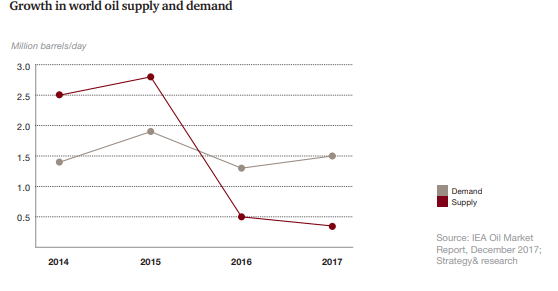

At the same time, the International Energy Agency (IEA) has been flagging the possibility of a supply crunch since 2016. More recently, the CEOs of Total, Eni, and Saudi Aramco have warned of one by the end of the decade. With oil demand growing, and investment in many major projects having been deferred during the downturn, there is less potential supply available. Oil companies will need to boost their production, and there is a risk that some may struggle to keep up. Producers need time to address the vagaries of an over- or under-supplied market.

The fundamental challenge is the volatility in the sector

Global upstream capital expenditure, which dropped nearly 45 percent between 2014 and 2016 is now forecast to rise 6 percent year-on-year in the medium term. Oil and gas rig activity levels are rising, driven by the North American market, and major projects are being approved. To name a few examples: BP went ahead with the second phase of Mad Dog, a floating production platform, in the Gulf of Mexico. Shell reached a final decision to invest in the Penguins field redevelopment, its first new staffed installation in the northern North Sea in almost 30 years. Exploration is on the rise again for the first time since the global recession.

Oil and gas companies will also need to grapple with the pace and magnitude of the transition to energy from non-fossil fuel sources.

Facing these uncertainties, oil and gas companies must develop a resilient strategy to mitigate these risks.

Resilient portfolios, innovation, productivity, and capital efficiency are the keys to success

Many industry players continue to neglect the supply side of the global energy situation and assume an overconfidence in supply. Demand continues to exceed annual forecasts, inventories are being reduced, and reserves are not being replaced. Market values for example, backwardation (in which futures prices trade below expected market prices) and forward pricing curves reflect a belief that supply is easy to increase and demand will flatten. Nonetheless, the world remains dependent on oil and gas. The need to find more of both resources will become more pressing over the short to medium term.

Volatility is also likely to continue in market fundamentals, thus affecting oil prices. As operators assess the impact of various scenarios from supply constraints to low carbon, they need a plan of action. Portfolios have to be resilient, innovation needs to thrive, and productivity and capital efficiency must remain the bedrock of operations. Looking further out, companies will need a robust strategy for hydrocarbon weighting: a strategy that will serve them no matter what the future brings. Only those companies who can do all this will prevail.