A study prepared by KPMG experts analyzed the impact of the COVID-19 pandemic on the Russian e-commerce market. The authors of the review conducted surveys and interviews with industry representatives and experts and tried to identify key trends, drivers and prospects for this activity.

The Roscongress Foundation presents the salient points of the publication accompanied by fragments of broadcasts of relevant panel discussions from the business programme of international events held by the Roscongress Foundation.

The pandemic has become a catalyst for the development of the e-commerce market, with all segments showing positive sales dynamics in 2020.

The e-commerce market was actively developing before the pandemic, but the previously launched process of transition from retail to online accelerated in 2020 because of the pandemic and, according to experts, this trend will continue. The pandemic has become a major catalyst for the development of Russian e-commerce: according to Data Insight in 2020, the volume of Russian e-commerce market grew by 57% compared with the previous year and reached RUB 2.7 trillion.

At the same time, all segments of the online market showed a positive trend in sales, and the greatest growth in 2020 (172%) was observed for food products, as people have adapted to shopping online in this segment due to restrictive measures. It is worth noting that while sales growth was observed in all segments, not all online goods were the absolute beneficiaries of the pandemic: some consumers avoided buying clothes and expensive equipment.

The companies surveyed also saw an increase in total sales revenue, online purchases frequency and number of unique customers. The overall growth of the e-commerce audience is also noted: in 2020, it grew by about 10 million people. Moreover, most of the companies surveyed saw an increase in the number of unique customers among the 55+ age group as well, indicating that the audience for online sales is expanding. Growth in online sales turnover was reported both in Q2-Q3 and Q4 2020, indicating a continued trend of expansion and development of the online segment.

The pandemic has become a catalyst for the introduction of new solutions in the field of logistics and IT, work with mobile applications and the development of social networks.

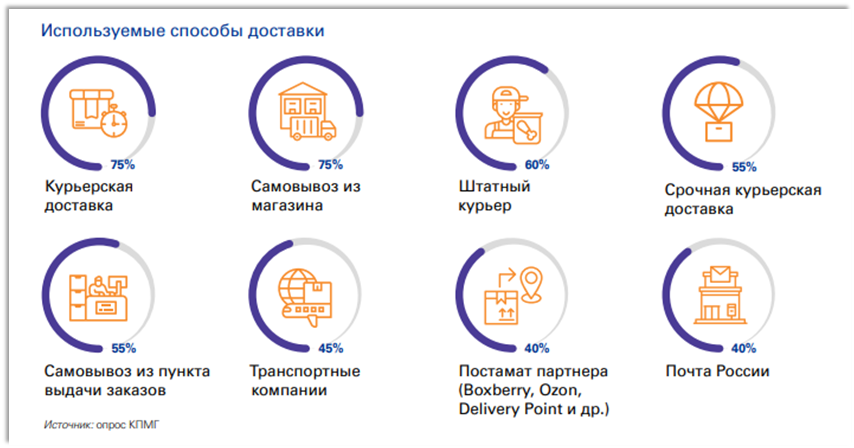

The restrictions caused by the pandemic have affected many areas that are in one way or another related to e-commerce. For example, many companies that have just switched to online began to look for ways to deliver their goods, and companies that have been operating in e-commerce for a long time began to look for new logistics solutions. Thus, according to the survey, 40% of respondents began to introduce new delivery methods during the pandemic and the restrictions in force among them the most popular were express courier delivery and in-store pickup.

Along with the expansion of express delivery in 2020, the study noted the following innovations in logistics related to lockdown restrictions: contactless delivery, as well as partnerships with courier and taxi services. The latter made it possible to cope with the increased load on warehouses and shortage of personnel in the field of order delivery due to the rapid growth of their number against the background of lockdown measures. Today, most companies try to use several types of delivery to provide maximum variability for the convenience of their consumers. At the same time, the availability of certain delivery methods among companies is explained by their popularity among customers: for example, courier delivery is popular with 94% of customers, and in-store pickup with 65% of customers in turn, 75% of companies provide these types of delivery.

The introduction of new solutions during the pandemic was also carried out in the IT sphere this fact was noted by more than half of the respondents. The study notes that the majority of respondents (65%) faced IT system outages due to the pandemic, so new IT solutions were mostly aimed at expanding companies capabilities. Businesses needed to eliminate outages, adjust to the new market realities and optimize processes to ensure sales volumes. It is worth noting that survey participants consider big data analytics to be the most breakthrough solution available on the market.

The mobile application market is also actively developing. According to the study, over the past five years, such sales were growing in the total turnover of Russian online retail, and in 2020, this segment has already provided more than 40% of the total growth of online sales market. Along with mobile applications, social media are becoming the key driver of e-commerce, and their role in the development of the sector during the pandemic has grown considerably. So, while 75% had already used social media advertising to attract customers, 20% of respondents only started it during the pandemic.

According to forecasts, the Russian e-commerce market will continue to grow.

The study notes that despite some slowdown, in the near future the Russian e-commerce market will continue to grow steadily at double-digit rates. Such dynamics will be due to a number of factors, including the simultaneous increase in the number of online-store users, as well as the growth of purchases per one such customer; the development of mobile e-commerce, which is the major driver of market growth.

Moreover, in the context of growing competition, the key growth driver for companies will be the quality of service, including established logistics processes and reliable payment services for orders. According to the authors of the study, the cooperation of manufacturers with marketplaces, which are gaining popularity in the country, will also be an essential growth factor. Whatever the case, despite the steady growth of online sales, online shopping will not completely replace physical one this is the opinion of 45% of respondents. Most likely, online will continue to develop and organically complement offline.

For more information, see the special sections of the Roscongress Foundation Information and Analytical System: StayHomeEconomy and COVID-19, dedicated to possible ways to stabilize the economy in a pandemic, as well as Digitalization, E-Commerce and Modern Consumer, dedicated to the development of digital technologies and changes in the commerce of goods and services.