Business and lifestyle

Qatar has one of the strongest economies in the world, with a credit rating of AA- and AA3 from S&P and Fitch and Moodys. Its GDP is expected to grow by 5% in 2021. Its currency is stable against the US dollar. Qatar is the number one country in the Arab world for supporting entrepreneurship and second in the Middle East for economic freedom (28th in the world), according to the Index of Economic Freedom 2019. Qatar ranks 10th among the most competitive economies and 5th for government effectiveness according to the IMD World Competitiveness Yearbook 2019.

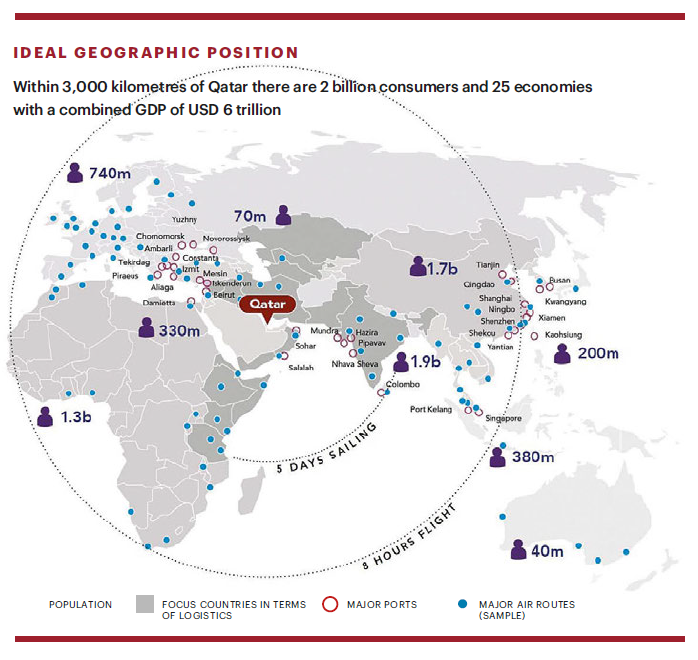

The country is a member of the Gulf Cooperation Council and has a longstanding relationship with the US, as well as several Asian and African countries. It has concluded agreements with the European Free Trade Association, along with other countries and regions. In particular, Qatar is a founding member of the Pan Arab Free Trade Area (PAFTA).

Qatar has one of the largest maritime cargo fleets, working in over 160 locations across the world, while Qatar Airways has the third largest fleet of air freighters.

A metro is being built as part of the 2022 FIFA World Cup in Doha. The hospitality sector is booming, while there has been an increase in the amount of green construction. The first commercial 5G network has been built, while the internet penetration level has reached 99.6%. Qatar ranked fourth in the world for its education system at the World Economic Forum.

The country is proud of its interesting business community. With the advantages of being in a free trade zone, it is home to the offices of Microsoft, Google, DHL, Volkswagen, Cisco, Vodafone, and the Rosneft International Center for Research and Development, among others.

Life expectancy in Qatar is 80 years old. It is the most peaceful country in the MENA region, the 20th happiest country in the world, and is the safest Arab country. Citizens from over 80 countries, including Russian citizens, dont need a visa to visit.

Prospects for investors

Qatar has one of the largest reserves of natural gas in the world and ranks third in the world for GDP per capita in terms of purchasing power parity, with USD 91,897 in 2020. The country also positions itself as a regional hub for investors from different countries.

To implement a unified investment policy, the Qatar Ministry of Commerce and Industry (MOCI) has created a unified brand, Invest Qatar. This is run by Investment Promotion Agency Qatar (IPAQ), which fulfils the function of an operator in coordinating licenced platforms in Qatar (MOCI, Qatar Financial Centre, Qatar Science & Technology Park, Qatar Free Zones and Media City). The platform the investor goes through to reach the Qatari market is determined by the specific features of the business. The agencys task is to assess the investors needs, select the best resources and platforms, and help with the registration and licencing procedures.

Investors in Qatar are offered attractive tax, finance, and corporate conditions. They also have the opportunity to make 100% foreign ownership (49% normally) and enjoy 0% tax on profit (compared to 10% in certain cases). There are no limitations on repatriating earnings or capital, and there is no income tax or customs duties. Moreover, Qatar offers investors access to financing, trusted and working laws on data protection and intellectual property, agreements with more than 65 countries on freedom from double taxation and zero risk for business expropriation.

The Qatar Chamber of Commerce & Industry (QCCI) and the Qatari Businessmen Association (QBA), for their part, have invested heavily in supporting and developing the business and investment environment.

The Qatar Financial Center (QFC) platform is designed for financial service providers and associated companies. It is a platform for banking, insurance, investment, brokerage, tax, audit, accountancy and legal fi rms and pension funds, among others. QFC is one of the three main financial centres in the Middle East and is 5th largest on the Islamic banking market in the world. The financial sector contributes USD 14 billion to Qatars economy, or approximately 8% GDP.

Qatar Science and Technology Park (QSTP) is a platform for hi-tech companies dedicating at least half of their research and development capacities to Qatar. QSTP works in sectors such as energy, the environment, health, IT, and communication technologies. Aside from coaching, innovate programmes, incubators, best practice exchange and the use of advanced infrastructure, the platform offers access to venture finance through grants and investment. Investment in research from the Qatar National Research Fund alone amounts to USD 1.4 billion. High tech contributes USD 3 billion to the countrys GDP.

The Qatar Free Zones platform specializes in separate major solutions in various industries, including the production of industrial goods and services, pharmaceuticals, biotechnology and medicine, the production of road transport equipment, energy and ecotechnology, construction and real estate, hospitality, consumer goods and retail, logistics, etc. As the platform is aimed at large established companies, it is the best platform for expanding into neighbouring regions. Two physical zones have been pinpointed for investors: Ras Bufontas, next to Hamad International Airport, and Umm Al Houl, next to a modern deepwater port.

Media City, the youngest platform, is suited to companies working in the sector of traditional and digital media, technology and communications. Euronews and Bloomberg Media have both been announced as partners of Media City. For companies with specific features that arent suited to the four specialized platforms, there is a fi ft h platform at the Ministry of Commerce and Industry (MOCI). This offers registration to general grounds based on Qatari law. But the regime, which offers non-zero taxation, limitations on 100% foreign ownership (maximum 49%), etc. will be applied to some companies. However, the requirement to have a local partner is gradually easing. For companies operating under this regime, for example joint projects (51% Qatar and 49% foreign participation), it does have its advantages. They can draw on the financial support of the Qatar Development Bank (QDB), which has programmes for SMEs and both operations within the country as well as exports. Being located at the heart of the Gulf region presents easy access to boundless markets in Africa and Asia. Suffi ce to say that within a 3,000-kilometre radius from Qatar, there are 25 economies with a combined GDP of USD 6 trillion and 2 billion consumers. Thats truly a global scale!