Small Business Sentiment Index

The study conducted by Alfa-Bank in collaboration with the international research company MARC aims to calculate the Small Business Sentiment Index, compare it with the index values of previous years, and assess the results. The study is based on an online survey of Alfa-Bank clients (legal entities and individual entrepreneurs with annual revenue of up to 350 million rubles) in the cities of Alfa-Banks presence in Russia.

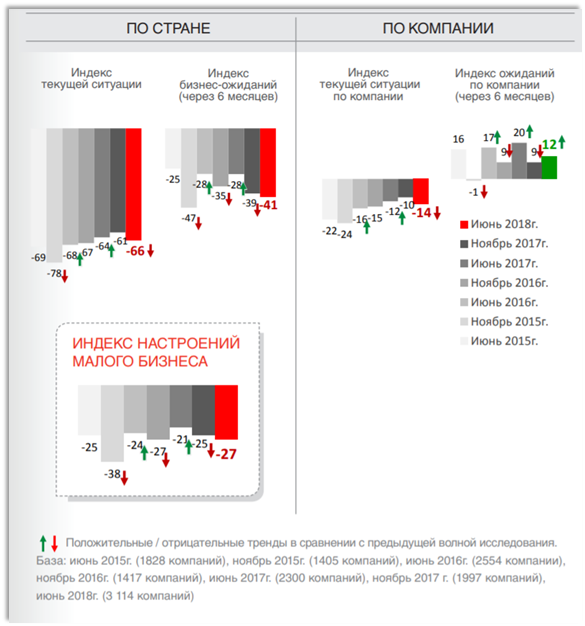

In calculating the Small Business Sentiment Index the analysts used the following indicators: business expectations of companies, their financial standing and plans for the future, sales and number of clients, export and import, business development involving the bank, and business profile. First, the following four intermediate indexes were calculated: current situation index, business expectations index, company standing index, and company expectations index. Then, these were combined to form an aggregate intermediate index, based on which the final Index was calculated.

The level of small business sentiment matches that of November 2017

Based on the results of the calculation, the analysts arrived at a conclusion that the Small Business Sentiment Index remained at the level of November 2017. Despite the growing prevalence of negative opinions about the current situation in their company, industry, and the country on the whole, entrepreneurs increasingly often state that they expect positive changes in the nearest six months.

The publication also examines regional and industry-specific features of small businesses, and touches upon the dependence of companies on export/import or on their relationships with foreign suppliers. Also, the report identifies some problems of small businesses. The majority of the respondents (46%) named high taxes as the main problem. Notably, 14% of the respondents stated that they had to rearrange their business processes to comply with new regulation.

Separate consideration is given to investment in business process automation and the use of digital technologies. It was discovered that 68% of respondents are actively investing in business process automation and digital technologies.

The final section of the publication gives statistics to present a generalized profile of small business in Russia.

This publication has been posted in the Roscongress Information and Analytical System on the recommendation of the Roscongress Foundation expert community.