A survey about the competitive environment in Russia

The Analytical Center for the Government of the Russian Federation has conducted a survey of representatives of Russian companies with the aim of assessing the competitive environment on the Russian market as perceived by the entrepreneurs themselves.

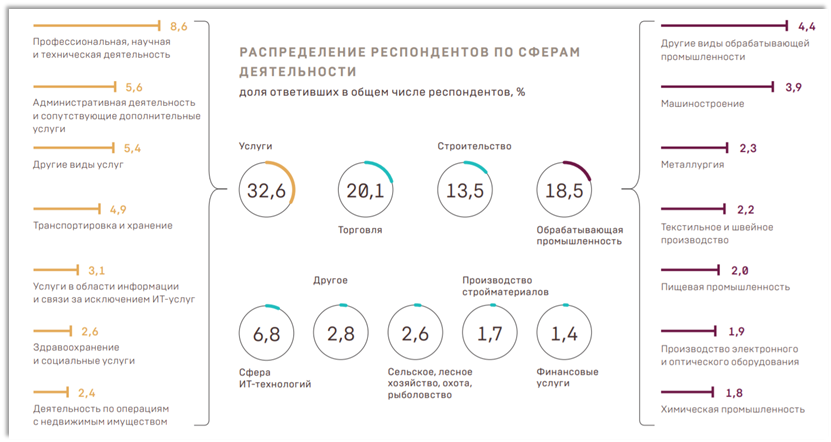

The survey covered over 1300 respondents from all Russian regions. Notably, the majority of the participants of the survey represent diversified companies (63%) mostly operating in the service sector (33%). Another important fact is that the majority of respondents represent small business. A typical member of the representative sample is an owner of a private business (73%) which has been operating for over 5 years (86%) and is targeted at markets of specific Russian regions or municipalities (59%) or the market of Russia as a whole (36%).

Main conclusions about the competitive environment on the Russian market

The study included an analysis of the dynamics of opinions about the level of competition which, for the first time since 2015, showed a growth in the number of respondents who stated that competition was high or very high.

Importantly, entrepreneurs retain positive attitude towards competition: they consider it a stimulus for further development and business expansion.

As for the factors that intensify competition on the Russian markets, the majority of the respondents (69%) named the emergence of new Russian companies on the market. In these conditions, the primary ways to increase a companys competitiveness are still low prices (39%), high quality (20%) of the product or service offered, and trust-based relationships with the customers (21%).

The respondents named high taxes (63%) as one of the chief barriers to business development. This factor assumes particular importance for Russian business because the value of this indicator has grown since 2018. Importantly, the activities of the state are largely perceived as negative as well, with 42% of the respondents stating that the authorities do nothing but hinder businesses with their initiatives (this parameter has also grown compared to previous years).

The results of the survey also indicate that Russian companies are slightly less willing to expand their operations now.

Its worth mentioning that in 2019, the respondents who represented the service sector were asked to indicate their segment. This enabled the authors to conduct a more detailed analysis of the competitive environment and the intensity of competition in the country, identify a number of trends in the system as a whole and the service sector in particular, and find out which barriers are perceived as the biggest in each segment.

It was discovered that in most segments of the service sector, the level of competition is moderate, standing at 45-55%. In healthcare, the competition is low (33%), while in the sphere of culture, sports, and entertainment, by contrast, the level of competition is estimated as high (78%).

This publication has been posted in the Roscongress Information and Analytical System on the recommendation of the Roscongress Foundation expert community.