The lack of quality projects and reduction of budget support for infrastructure industries determined the state of the infrastructure investment market in 2017. Experts believe that the relevant factors will continue to exist in the next two to three years. However, the infrastructure still attracts investors even without direct subsidies, and key players adopt to new rules.

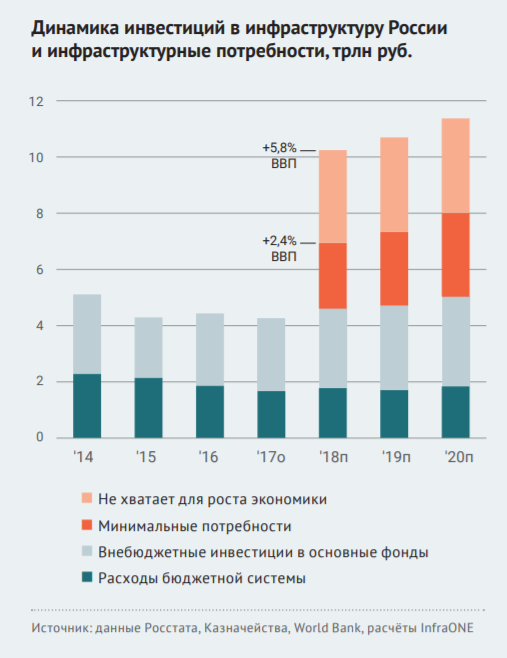

Budget spending on infrastructure again decreased in nominal and real terms, and their share in GDP fell below 2%. It can be stated that the budget system has reached its minimum. As a consequence, it is unlikely that budget spending on infrastructure will be lower in the coming years.

The current level, according to experts, who made the review, is about critical. Initiators of projects are slowly adapting to new conditions: large transport concessions, economy of which did not require large capital grants, will soon be launched.

Previously, all the initiators were claiming state subsidies. At the same time, a significant part of the market continues to rely on state aid, which, however, in many cases has negative effects.

Currently, all investments in infrastructure by the state and private sector do not exceed 4.8% of GDP or 4.3 trillion roubles. Moreover, a signification portion of extrabudgetary funds accrues to the public sector. According to experts, the minimum funding is 2.3 trillion roubles, and for development, another 3.3 trillion roubles is needed. There is enough money for the development of infrastructure in the market, despite all the upheavals that the banking system experienced in 2017.

The lack of projects ready for financing does not allow the money to get into the infrastructure, although such investments are demanded by the largest state banks and financial institutions.

According to the experts assessment, as of the end of January 2018, about 190-235 projects in various infrastructure sectors were discussed in the most advanced segment of the market (concessions amounting to more than 1 billion roubles), but only a quarter of them can be implemented.

Federal authorities and regulators attempting to stimulate investor interest are gradually softening and clarifying the regulatory framework. However, a careful assessment of regulation is required, since a poor assessment can lead to negative consequences.